GB Railfreight's CEO John Smith has a positive vision for the UK's freight market, as he elaborates on what has driven his company's market share growth...

The rail freight market value has been worth about £1 billion for some time.

What's hidden within that is the recent diminishment of coal and its replacement with deep sea boxes (containers).

There's been huge growth in the deep-sea market sector. We've gone from about 12 trains per day out of Felixstowe, to 38. That's a lot of volume, with societal benefit through lorries off the road.

At the other end of that telescope, rail transport accounts - at most - for only 30% of all boxes that are imported or exported through any of the deep-sea ports. That leaves room for much growth. A swing of 1 to 2% towards rail at Felixstowe represents another train.

You don't need it to shift much before you have another two, three, four or five trains. Take it up to 40% of boxes by rail, and you have another 10 trains. Constraints are then down to network capacity, but I believe there’s space.

For the long-term picture it makes sense. We must decarbonise by 2050 and everyone knows it. Requirements might be diluted depending on how far technology takes us, but a key step towards it, much like wind farms, must be more rail freight. You can't decarbonise the country without it - battery lorries don't really work other than for local distribution.

Many think that rail freight should move into high-speed parcels delivery, but the economics of it aren’t easy because it’s not well connected. Electric trains at 100mph on the main line to London terminals for onward distribution by battery lorry – that's the best scenario. But most mainline railway stations in London have been developed without the requirement for such facilities.

Preparing for tomorrow, today

When we started GB Railfreight (GBRf), we didn't have much cash, so investment was limited. We frequently borrowed money, either via leasing companies if it was rolling stock, or via debt if we were endeavouring to build something.

In the last decade, we've been generating our own wealth and that's allowed us to invest.

Our latest investment has mainly been around rolling stock maintenance. Sometimes our contractors fund investments like the Electromotive Maintenance Depot at Roberts Road for our Class 66s.

At Peterborough, GBRf has invested its money in a new rolling stock facility. Smith says that the underlying problem is quality and standard of wagon maintenance: "Just like the airline industry, a plane doesn't make money unless it's in the air."

The premise of GBRf was to build itself around our people. Today, we still manage the business around individuals - we do it in a very open and inclusive environment.

We've speculated. People can be trained relatively quickly between three and six months, and we now employ nearly 1500 people. You get worried that as the business gets bigger, things might become more difficult.

To combat this, we trust people with information, so they can make the right decisions and that allows them to understand the importance of what they do. With five owners since 1999, we've been empowered to get on with things.

Placing locomotive fleet orders fuelled our growth and put us in a position where we could step into bigger contracts. The freight industry has contracts that require just one train and a locomotive, but bigger customers require 5, 10, 15 or 20 trains a day. You need more than one locomotive to do that.

Our transition point was around 2015-2016 when we placed the biggest order for the last builds of the Class 66. That really gave us a ‘leg up’ and allowed us to pitch for bigger contracts.

Agility through confidence

I like to think that with growth, the business is as nimble as it was perhaps 15 years ago. But I think I'd be a liar if that really was the case. I don't want to get woken up at 02:00 in the morning – I just want people to get on with what they're paid to do.

Sometimes you need to dip back in and remind people that they have the authority to make decisions. No decision is the worst scenario. You might get one decision in 10 wrong and there’s a bit of angst around it, but at least you're deciding.

As the business grows, the key is who you employ and their calibre. It's often about bringing people into this environment and growing them from within. We're exposing younger employees to how things ‘tick’, hoping they’ll add value in the longer term.

And, you know everyone when it’s a business of 100 people. Some argue you can’t keep that going as a business grows, but I think you can with modern technology. We don't have a shop floor where we can say ‘gather round’, but we do have online systems and briefings. I've had drivers on holiday who log on and listen, and they'll give an open and honest view of what's taking place. There’s appetite to consume information and it keeps the inclusiveness going.

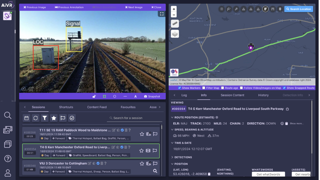

Embracing technology

After the election, there'll likely not be much money left for investment for whichever political party is in charge. I've a feeling the health service and defence budgets might be further up their pecking order. But government can still work with the private sector to make the incremental changes that will grow our industry.

The Treasury propped the passenger railway up through COVID, and it cost a lot of money. On the freight side, we had to furlough. After almost two years of rail strikes, you can understand at a human nature level why someone in Treasury might be upset at our industry.

The likelihood is that there’s not going to be much investment in our industry for five to 10 years. You need the economy to turn around first. So, we’ve procured bi-mode locomotives.

An impression of how the Stadler-built Class 99s for GBRf might look. The 30 new bi-mode locomotives are under construction at the manufacturer's Valencia plant with deliveries planned to the UK in 2025.

The key is embracing technology. We’re not a tech company, we’re a train operating business. If you're buying a car, there's much research and development before you walk into the showroom. We had to go to the few suppliers that exist and ask, "Can you build a locomotive for the UK that’s more efficient, and that will serve our industry for the next 20 to 30 years?” The Class 99 is a modular design that will allow it to adopt technologies of the future.

I believe the future lies in hydrogen. But hydrogen technology is still a long way off - the hope is that we can convert our locomotives to run on it.

On February 6 2023, GBRf's 66715 'Valour' is at the helm of a spoil train departing Willesden Euro Terminal. Each train of spoil (extracted from the construction of HS2's London tunnels) removes approximately 83 lorries from the road, reducing congestion, air and noise pollution. Willesden's premise from 1994 was to handle continental freight entering the UK through the Channel Tunnel, but with a decline in freight entering the country via the tunnel, it was short-lived.

Through to the continent?

When GBRf was run by a Swedish private equity business, our parent company had a rail freight business in Sweden and another in Germany. For my sins, I ran both for a year. Similarly, when we were owned by Eurotunnel, it had a freight operation in France and still does.

The logic was that the whole would be worth more than the sum of the parts at the point GBRf was sold. That was their perceived integration of rail freight through the Channel Tunnel and to mainland Europe. And, as a freight operator in the UK, the logic was that we joined the two. On neither occasion did it work. I've always thought if we can't do it, I'm not sure who can.

My view of running an isolated rail freight business in mainland Europe is that you must compete against state-owned monopolies. State-owned monopolies have no capital at risk - unless a government withdraws funding. And there’s no drive to be efficient with rolling stock.

Costs aren’t properly understood in nationalised industries because they become lost. Consequently, bids can be submitted below cost to guarantee work.

Several rail freight operators in Germany have half or more of their equity owned by local government to get more freight off road. They're not necessarily profitable.

We used to work from Germany, with container trains going up through to Scandinavia, and the levels of efficiency within inland terminals in mainland Europe is appalling compared to the UK. We run the most efficient rail freight operations of any country I've worked in.

Crystal ball

Regardless of having a good, bad, or indifferent year this year, the future for rail freight must be positive. I’ve seen rail freight change dramatically the past 20 years, even with a lack of capital investment from government, the private sector has innovated and found new markets.

The Government’s new rail freight growth target will help. It will get the industry and policy makers focused on what’s important – and that’s not always big investment.

It’s about connecting our sidings, about things like improving signalling on the single track to the quarry at Skipton, or about how we can get another rotation out of a set of assets in 24 hours.

The future for rail freight is bright, everyone whether they know it or not is a rail freight customer and that will only grow as we approach 2050 and the Government’s net zero targets.

Login to comment

Comments

No comments have been made yet.