Our railway is approaching an inflection point. Will the railway be able to grow its revenue base to stave off pressure to cut costs? Or will service and quality cuts accelerate to produce a spiral of decline?

Right now, there are some confusing signals about the experience passengers are receiving when travelling by train, so it’s a bit tricky trying to make an objective assessment of the state of play.

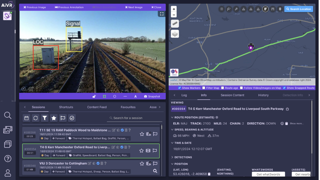

Many train operators’ services have become progressively less reliable over the past year. Punctuality is in long-term decline, cancellations are now commonplace, short-formation trains have become a regular nuisance, weather-related interruptions to service seem to be becoming more frequent and extensive, and strikes continue - seemingly without any end in sight. Add to this the latest trick of removing trains from the timetable the night before they are due to operate - apparently to provide clarity on the service which will actually operate, but which instead feels more like smoke and mirrors designed to flatter the official cancellation statistics.

Anecdotal evidence also suggests that all is not well with many of the softer touch points affecting the passenger experience. Train toilets out of order, station lifts not being repaired quickly enough, reduced gateline operation, dirtier trains, and reduced on-board catering are all indicators of cost reduction being prioritised over the customer experience.

But despite all this, a strange thing seems to be happening: commuter ridership on Tuesdays to Thursdays is observed to be steadily improving since the Christmas break, and leisure traffic is reportedly booming to levels never before seen. Thursday is the new Friday, and weekends are in danger of becoming the busiest days of the week, despite all the engineering work disruption that can be thrown at them.

We can also observe that service quality is being experienced unevenly around the country. Scrutiny of cancellation and punctuality statistics for the 12 months to January 2023 shows a wide divergence: c2c, Chiltern Railways and Greater Anglia stand out at the top of the reliability league table, while the Elizabeth line, Merseyrail and London Overground top the charts for punctuality. Interestingly, the most punctual operators are those which are not contracted to the Department for Transport.

Sitting on the bottom of both league tables - with clear blue water between it and the next worst operator - is Avanti West Coast.

On average, in the last 12 months, it cancelled an astonishing 8.8% of those trains it planned to run the night before. As for those which it did run, just 62.7% arrived at stations within three minutes of the advertised time.

This is a truly appalling track record, and the DfT is now facing an awkward choice between entering into a new short-form contract with Avanti’s private sector owners or mobilising its Operator of Last Resort. It certainly won’t want to bring it back in-house, but it is running out of credible alternatives.

Yet Avanti is not on its own in the reliability relegation zone, with TransPennine Express, Govia Thameslink Railway and CrossCountry all clocking up a cancellation rate of over 6% for the year.

You might expect this litany of deterioration to produce lower passenger satisfaction. But a strange thing is happening here too. “Overall satisfaction with rail journey”, as measured fortnightly by Transport Focus, has maintained a broadly flat line at around 85% across the last four months of travel disruption, while “satisfaction with punctuality/reliability” is hovering at around 75%. Satisfaction with “value for money” actually improved in January, perhaps a reflection on the decision to delay and cap the fares increase.

With seemingly no end to the industrial disputes, managers at English train operators are increasingly focusing on demands from the DfT for additional large-scale cost reductions in their 2023-24 budgets. Colleagues at Network Rail are also wrestling with their funding envelope for the five-year period starting in April 2024 (while this might have appeared relatively stable on first reading, in practice there are pressing needs to fund substantial additional earthworks to tackle the deteriorating condition of these, meaning that other areas of expenditure are under pressure).

And while passenger numbers are rising, they are not bringing in as much money per journey as they did historically, so industry revenue remains well below pre-pandemic levels. This shortfall explains why the Government has stuck to its policy of not agreeing to inflationary pay increases for railway staff, and goes some way towards explaining its preoccupation with reducing the industry’s cost base.

Unfortunately, it is so focused on cost reduction, with revenue reportedly being taken straight to the Treasury, that there is a disconnect between cost and revenue in decision making. This is very bad news, as it results in decisions being taken which can be short-sighted or perverse - and sometimes both of these at the same time!

I wish I could paint a more positive picture of what 2023 is likely to bring for our railway. But unless there is a significant change in government policy towards rail, and until there is settlement in each of the main disputes currently affecting service operation, the future looks bleak.

We can expect the Government to continue to apply relentless pressure to reduce costs. And as there is a limit to how much cost can be taken out of infrastructure while keeping it safe to operate, this will result in demands to cut service frequencies, train formation lengths, operating hours on some lines or routes, and so on. But because the fixed element of the cost base is relatively high (at least in the short to medium term), such actions have a skewed impact - a smallish reduction in total costs and a disproportionately large impact on the passenger experience.

This dystopian version of the short-term future is coming to a railway near you very soon. The approach currently being taken is a certain route to doom. The only way out now is to prioritise revenue growth. We need to focus on driving more bums to seats (and making sure those seats get paid for) as fast as possible.

To enable this change of approach simply needs the reunification of revenue and cost management at train company level, and the setting of profit (rather than cost) targets for each operator. This does not require any changes to structure, leadership, or the current mix of private and public sector engagement. It just requires the Government to make a simple decision to let railway managers manage.

There are two feasible ways forward: boom or bust. I urge our government to choose the first option.

Michael Holden

You can subscribe for print/digital access via http://www.railmagazine.com/subscribe

Login to comment

Comments

No comments have been made yet.