It’s been a challenging period for Freightliner Heavy Haul, but one from which it has emerged stronger for the experience. The company’s turnover is around £140 million per year, and this will likely grow in the future, thanks to a host of new opportunities.

Indeed, rail freight has a wealth of ambition… and the major freight operators all seem optimistic regarding the future of the sector, with an increase in the number of new flows.

FLHH Commercial Director David Israel is certainly of the belief that the future is bright. He admits that times have been tough, but that now the future is much rosier.

“We were hit by the recession, but we managed it, and very successfully. We managed the workforce - we are proud to say that we came through it with no redundancies.”

There was natural wastage, as recruitment slowed and staff retired or moved elsewhere. “There was pain, of course, but all of a sudden we came out of it.”

Israel describes the performance of rail as “a barometer for UK plc. One customer had a big upturn, and that came through overnight.”

That customer was Network Rail and its National Delivery Centre (NDC, previously the National Delivery Service). As a result, volume increased overnight.

“That was two years ago,” says Israel. “We accepted that, and then the coal sector picked up again. Then aggregates, steel, cement… everything picked up. I have been in the transport business all my working life, 30 years, and I have never seen that before - all happening at the same time.”

Moving out of a state of recession so quickly presented its own challenges. FLHH had to service its existing contracts, while also sourcing enough locomotives, wagons and staff to facilitate the new growth in the market. Some work had to be turned away, although Israel acknowledges that these are factors that must be tackled if the sector is to grow.

He also believes that freight doesn’t get enough access: “Definitely not. We only pay a marginal cost, is the argument, but look at what freight has done for the UK. People forget that.”

Certainly rail freight is set to become a vital cog in UK plc’s plans over the next few years. There are commitments to build and widen roads, as well as construct thousands of houses, and rail is seen as a greener and more reliable way of transporting materials.

The leading freight operators all see aggregates as a key market, and have eyes on the planned developments around the UK. Israel is no different: “We have to serve the road building and housing markets. Then there is HS2… Crossrail 2… there has to be Government funding.”

What does he mean by that?

“Help with terminals. We are looking for new sites, and not just in London. They are hard to find. There are some left, but there are some that are too small.

“It varies in what you need. Sometimes it is a siding and a pad, to something far more complex. Sometimes you need bagging facilities, platforms and silos. Maybe even warehouses. It all depends on what the customer wants.”

He returns to the subject of access, and the concerns over getting better paths on the main line. But the railways are close to capacity - for example, the West Coast Main Line south of Rugby is the busiest section of main line railway in Europe, while there are reportedly access issues on the Midland Main Line. Both could be strategically important routes for rail freight to reach London and its booming construction sector.

“To make freight competitive we need direct trains and we need better turnarounds,” says Israel.

Terminals also need improving, he believes: “There needs to be quicker tipping speeds, increased length of sidings, and more storage space.”

Rather than running more trains, it seems that running longer trains is the answer, which makes sense - after all, if there is no space left on the national network, applications for more trains are hardly likely to be approved.

Even so, where are the concerns for FLHH? Where are the capacity constraints?

“The Hope Valley, Bristol and Doncaster are the issues,” he says. “But it is everywhere. The MML is horrendous.”

Not all of FLHH’s core businesses are necessarily affected by the problems of access, with Israel acknowledging: “The coal sector is not an issue, although a quicker turnaround would be good.”

The alternatives do not offer a good future for rail freight, he says. If there is no support from Government, then quite simply the sector could face major problems. “They will look for alternatives. It will go by road.”

The knock-on effects for customer supply chains are a concern for Israel. Pathing is therefore something that FLHH is taking seriously. Israel says the company has a specific team looking at pathing work and engaging with Network Rail to try and improve matters. For its part, Israel says, NR is supporting the operator, but he admits that that is being done “slowly”.

The age-old concern regarding what happens when there are delays is also a problem for FLHH.

Explains Israel: “We would be looped, which causes delays. That needs to change. For instance, half of the rural passenger trains have low numbers, and yet we are looped. There has to be a deal done with train operating companies.” He adds that freight is already barred from operating in some peak period areas.

With NR increasingly introducing Alliances, where does this leave the freight operators?

Israel believes that a balance needs to be found, although FLHH is already working with NR, in its National Delivery Centre deal that includes moving the High Output Ballast Cleaner (HOBC).

“We have done very well for volume,” he says. “We do all the HOBC work. There are six pieces of kit.”

At the time of our meeting with Israel, two were at Tyne Yard, one was at Toton, one at Willesden, one at Crewe, and one at Taunton. The Taunton equipment has since moved to Harwich Parkeston Quay to work on the Anglia renewals scheme.

Another key area for FLHH is Basford Hall - a strategic area for the operator with increased throughput from NR. It is as vital to FLHH as a major port is to intermodal traffic.

More than three million tonnes of ballast pass through the yard each year, which is sufficient to employ a Class 66 for shunting. However, this is a resource that FLHH could do with on the main line. As a result, FLHH will hire a Class 56 from UK Rail Leasing to provide the shunting, releasing the ‘66’ onto main line flows.

As a barometer of how demanding the NR contract is on resources, Israel says FLHH recently provided 53 Class 66s to NR for one weekend. That included hiring from the intermodal business if required. This particular weekend also required significant planning of drivers.

“We had to get that right, and the whole system worked well,” says Israel. “I remembered from my days at EWS when we had problems, and so I was thinking that there would be problems with this. But there wasn’t. The customer was happy and it was all very pleasing.”

The operator is keen to develop its staff and currently runs six training schemes. “We have strong recruitment schemes and are also developing our current staff,” says Israel.

He says that strong candidates have been employed, and are now learning in the classrooms before they start the practical work, before admitting: “There is a shortage of drivers.” He suggests driver training takes around nine months, and points out that it is a highly skilled profession.

Within the wider Freightliner Group, Israel says that Freightliner Maintenance is recruiting more fitters, which will help the business. “It’s not just FLHH - each of the Freightliner subsidiaries are supported to ensure the successful running of a 24/7 operation,” he says.

Where does Israel see the business growing?

“Aggregates is buoyant,” he replies. This is despite work with Aggregates Industries in the Midlands transferring to GB Railfreight, which has led to resources from that contract being deployed elsewhere. Israel highlights that there is more work available that FLHH is looking at to replace this, but is coy when asked what that work is.

Assets need to be considered, he explains. “Locomotives can go anywhere. There are one or two flows that have started. There is a Tunstead-Elstow which is new to rail, and we have the Brentford flow that GBRf no longer operates.” He adds that other work is lined up: “It is something we are looking at.”

Israel draws attention to forthcoming changes within the aggregates sector that could have an effect, such as the potential sale of Lafarge Tarmac. “There is a little bit more consolidation,” he says of the market.

There is also a niche market for rail services: “We hire drivers to First TransPennine Express. That is something we have done for many years. We supply up to 14 for eight duties. They operate in the North and are Mossend-based drivers. That works very well.

“When there were Reading blockades and First Great Western diverted via Salisbury and Banbury, we conducted the diversions.”

He adds that diversions over the same route in April will again feature FLHH men conducting FGW drivers.

Elsewhere, Class 387/1s built by Bombardier for Govia Thameslink Railway are being tested by FLHH staff, having been delivered to Bletchley by FLHH. Israel says that work came about as a result of a phone call from the manufacturer, and is a business that is “starting to pick up”.

However, one area that has partly stalled is biomass. “There is a lot of effort needed. It certainly ticks the green boxes, but is subject to constraints by lack of subsidy to generators.”

Israel adds that coal is busy at the moment, but highlights a concern: “The carbon tax kicks in in April, so that will be a quiet spell.”

Meanwhile, the cement market is booming, and changes of ownership within the industry may create opportunities here.

“It’s flat out,” says Israel. “We also haul all cement from Earles Sidings, and I have never seen that busier. This all indicates that we will get even busier as cement volumes continue to grow.” He says that longer trains are being investigated.

Indeed, longer trains are already being used elsewhere, with 90-tonne HIA aggregate hoppers now running in 27-wagon formations. But like the cement flows, this presents challenges, of which terminals are again a major one: “We can split trains, but the loops need to be longer, too. We need support for that.”

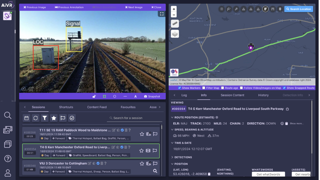

Israel says FLHH is always seeking ways to improve and innovate the business. One such element is the Freight Performance Measure, introduced to monitor freight train performance in a similar vein to the Public Performance Measure for passenger trains.

“It is still early days and needs review. There seems to be a focus, rightly so, on terminal departures, and Network Rail has certainly upped its game on monitoring.

“We are focused on getting to the point of departure, and the team is monitoring that daily. We needed to beef it up and the team is doing a great job.

“On the ground the message has gone out that if there is an issue, then report it. We need Network Rail to help, and they are engaging.”

Regarding rolling stock, Israel says: “We are looking for wagons and we are assessing electric traction. There is nothing hard and fast - we know we have the time to look.”

The signs are positive from FLHH. Since the business was established in 1999 it has enjoyed remarkable growth. It has come through the recession and business is now booming, and seemingly growing at a fast pace.

It’s Israel’s job to ensure that FLHH can keep up with the market. It’s a challenge he is more than happy to face.

- This feature was published in RAIL 769 on March 4 2015

Login to comment

Comments

No comments have been made yet.