- This feature was first published in RAIL 871 (January 30-February 12 2019)

The amount of UK rolling stock about to be sent off-lease is an opportunity, according to Karl Watts.

A career railwayman, Watts is the chief executive of Rail Operations (UK) Limited. He is a man with a plan. And over the course of almost three hours in the company’s offices in Derby (which they are soon to move out of), he explains just how that plan will work.

Watts was one of three founders of Rail Operations Group (ROG), which was set up to serve the rail services business - hauling new trains from factory or port to their new depot, taking trains for refurbishment, or moving off-lease trains.

The company developed innovative ideas, such as the ability to couple a 50-year-old Class 37 to the latest new train. This meant that rather than delivering the new-build set as part of a freight train that could take several hours to marshal and shunt when arriving at the train’s new home, the ‘37’ could simply arrive, uncouple and leave. A job that would take several hours now took as little as ten minutes. This caught the eye of the industry, and soon ROG’s portfolio was growing.

Not every train was hauled by a locomotive, as the company’s staff could also drive most traction. And so trains heading for refurbishment, such as Greater Anglia Class 321s, Northern’s 15x fleet and High Speed Trains for ScotRail, were all being driven by ROG staff. Quite often a headboard was attached to the front of these train, as the company sought to extend its reputation.

But that market is not going to last forever, and so Watts is expanding now.

Ten tri-mode Class 93s are on order from Stadler, representing a significant investment from a company that was only set up in 2014.

A second office move is about to take place as staff numbers grow, in tandem with the number of roles required by the business. There is also the possibility of a new London office to support the headquarters in Derby. These are exciting times for the fast-growing company.

But Watts is always looking to the future. “It is very, very clear that the world of new stock delivery and testing is becoming increasingly complex. Then there is the re-engineering and taking trains out of store,” he tells RAIL.

Rail Operations (UK) Limited is the parent company, supported by four businesses. Watts works for the main division. The roles of the parent company are: corporate governance (Watts is responsible for how the companies are run); strategic direction (“it’s about conquering the world and then moving to the next phase”); asset management (the Class 47s are owned by this and sub-leased to ROG); and project management (this is where the ‘93s’ come in).

The four businesses are: Rail Operations Group, Traxion, Orion, and a passenger company that as yet has no name.

ROG is the most well-known, and is the haulage business for rolling stock, Traxion is the business set up to handle the storage of off-lease stock, and Orion is a logistics firm. The passenger company has yet to receive a name, as it is very much on the back-burner. Each business will have a Managing Director who will report to Watts and the Executive team.

“ROG was set up at the end of 2014 just as DB Cargo UK won the Crossrail deal,” says Watts.

“That involved £15 million Class 345s being delivered. These ran unbraked in the middle of a freight train and ran at 45mph up the West Coast Main Line. Now, we deliver it with a ‘37’ and no barriers.”

He says that for this to happen, ROG had to engage with Dellner (which designed the couplers).

“The design of the coupler we have lets us drop the height. The adapter was done so it sits at the right height for the requirement. We got a leading former British Rail electrical rolling stock engineer to design the electrical gear, because we knew that the length of the train we were moving would increase and that the translator equipment was not powerful enough for a 12-car train. It now is. And the ‘37s’ have a box in them that allows us to switch the supply to support the unit it is hauling.”

ROG’s growth has been staggering. Says Watts: “People ask what is the story behind the success. It’s not one thing, but if I had to select one I would say it would be the business plan. I have to renew it every six months. And we have always stuck to the plan.

“We always underestimate, too. Our financial turnover this year will be £12m, and in 2020 it should be £23m. In 2022, across the businesses it will be £30m.”

As a result of studying what the market needed, ROG has been able to record average growth of 91% year-on-year.

“Without a shadow of a doubt this innovation did us the world of good and got us the business we have. It takes two hours to wrap a unit up in the freight train. We can do the job in ten minutes.”

But while the market has grown rapidly for this kind of work, so have the issues become more complex.

“The market has increased in recent times with more rolling stock owners, and we have a former BR word - standardisation - that has gone. The situation now is there are eight different couplers. All trains have Dellners, but there are different ones.

“We have five different height couplers. The lowest is 925mm, the highest is 1,054mm. Then there are the different mechanics… different controls. And you can bet that mechanical couplers will not work manually.”

Those are the technical issues, but there is more. Watts believes that the “chaos” around franchising and manufacturers being overambitious doesn’t help.

“We will always have problems introducing new trains. That has always been the case, but that is why you do testing and commissioning,” he says.

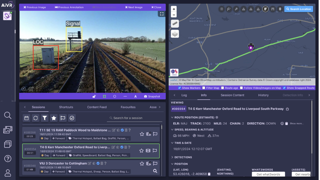

ROG is contracted to help with the testing and commissioning of a number of new fleets, such as Greater Anglia’s Stadler units and London Overground’s Class 710s, and acting as support for CAF’s Northern units.

“Approvals are very, very stringent, and they can take a long time. But we are not involved in that,” explains Watts.

“It varies from contract to contract for us. Bombardier did the deal with us for ‘345s’/‘710s’; Greater Anglia appointed us for Stadlers; Porterbrook did the FLEX deal. CAF did CAF, but there is CAF Spain and CAF UK, who are very different. We will be the test operator for the re-engineered Class 442s for South Western Railway.”

All told, ROG is currently involved in some 30 projects.

Watts explains: “Our work includes all train manufacturers, engineers, 60% of train operating companies. We have stopped driver hire these days - it is not part of the business. Today our business is 40% locomotive haulage and 60% own power.”

Watts says that unlike passenger and freight operators, ROG doesn’t have a routine plan for operations.

“We are dynamic in that respect, and I think quite brilliant in the way it works. And that is why we get repeat custom. As one customer said to me, we have changed operations to a dial-up service.”

ROG boasts a 65-strong workforce that it expects will grow. Drivers are given a roster the week before (usually on a Thursday), but know that will change.

“The guys love it. There is massive variety - we have 40 types of traction and operate nationwide. The drivers are actually operations managers. And they are managers - their contracts reflect that. And they are the highest paid on the network - the basic salary is £73,000.”

But what of the other businesses?

Traxion began trading on August 1. So far, it leases two sites - Crewe South Yard and Marks & Spencers Logistics site at Castle Donington. More sites are being investigated, and these will all be leased.

Says Watts: “There are 4,000 vehicles coming off-lease, and they vary in age. Some second-generation EMUs will be disposed of straightaway, like the ‘313s’, ‘314s’ and ‘315s’. They will go straight for scrap. Class 317/319/321/442s are very, very likely to be re-engineered, and that is not a quick programme and so they will need storage. So we saw this coming - we’ve done something about it and are the go-to company.”

However, Watts acknowledges that storage is not simply about putting a vehicle in a siding and leaving it: “It’s up to the customer, but there are various levels of warm store. It’s about the robustness of maintenance when in store, which could be cold store through to ‘flight ready’. The latter is where it could re-enter traffic the next day.”

Watts explains an interesting dynamic whereby some trains are coming out of traffic before the lease ends, and remain the responsibility of the train operator. But there are other challenges, he says. For example, most of the trains are electric.

“Crewe has three roads wired and that is a Godsend. But normally it will mean that we will have to put in warm store, and when they need running we will need a locomotive to drag them to a suitable location.”

Then there are delays to the introduction of new fleets, and the subsequent impact.

“The plan was for the first IC225 to be off-lease this month , and then two sets per month through 2019, but that has been delayed by the Azuma commissioning. That affects our plans, but our storage is dynamic. We cannot commit to a site until we’ve signed the deal.”

He says Traxion is looking at Network Rail and Ministry of Defence sites. “Security is important, and as such new trains will need ‘hiding’. I have a site in mind for the IC225s. We won’t have full-time staff there, but there will be full-time security. There is a need for 46/47 miles of storage space if all fleets are stored.”

However, the real game-changer for Rail Operations will be Orion. And this is something Watts has been eyeing for some time: “It’s about modal shift from road to rail. We looked at this a few months ago. We recognised that actually this never worked in the past as the timings never worked.

“Parcels and express delivery will be worth £16.7 billion. If I get 5%, it’s a lot. I want 10%. I want a system of 100mph and 125mph networks. It’s the return of Rail Express Systems, but with more sophisticated traction and rolling stock.”

He cites Government data explaining how the number of commercial vehicles has increased. Heavy Goods Vehicles have declined, whereas Light Goods Vehicles have soared. In 2012, there were 1.5 billion parcels delivered. In 2020, that will be 4.6 billon.

Watts wants that market, but these goods are lightweight and so he needs the right type of vehicles.

“In that case, I am talking about using passenger trains. Then I need to think: where am I going to get them? Well, there’s 4,000 vehicles available!”

What does the market want?

Speed, replies Watts: “We looked at parcels operations, although I prefer to call it logistics. On secondary routes, we think 100mph would suffice. By these, I mean off the premier routes. The premier routes are the East Coast Main Line and the West Coast Main Line - the Anglo-Scottish routes. These need 125mph for the paths, ideally.

“When talking to potential customers we have found that we need credible timings. Network Rail has told the freight industry that paths need surrendering and several thousand have been given up - the capacity is there if you can live with 125mph Pendolinos and Azumas. We need to get going, fast, and then keep going. Network Rail has also told us that any trial will have free track access.”

To this end, Watts and his team have been talking to rolling stock companies (ROSCOs) about stock. But he’s ruled out diesel-only High Speed Trains.

“You cannot go to someone like Sainsbury’s and offer a 40-year-old heritage train. Emissions are key these days. It may work as a part of a hybrid bi-mode set, but the HST won’t be the prime mover, and an HST running 400 miles under the wires will never work politically.

“But the concept of bi-mode is not new. Remember the Class 91 and 43 DVT on the ECML in the late 1980s? I tested them. The concept is well-established. If you need 125mph paths then there are ‘91s’ available, and if you need 110mph paths to suffice then maybe use a Class 90 or ‘93’ . It must be Mk 3s. I am talking to the ROSCOs.”

Two Class 769 FLEX units have been ordered from Porterbrook (RAIL 868), with Watts explaining: “We need something tangible to show a sector that is tired of glossy documents.”

The four-car tri-mode units will be used on secondary routes, although where has yet to be decided.

“The plan is to sign the deal and contact key players in the industry. I have been talking to Amazon and Royal Mail, but there are 190,000 logistics companies in the UK. OK, some are one man and a parcel, but not all of them.”

The first ‘769’ will be delivered next November, with the other a month behind. Rail Operations is risk-averse, so the trains will retain their passenger information systems and data hubs, so that (if needs be) they can be returned to the passenger sector.

Discussions have taken place with high-tech consultants regarding the use of autonomous vehicles that can complete the last mile to deliver to stations and terminals. However, the technology needed to navigate the streets of London safely is not sufficiently sophisticated.

Says Watts: “The technology is established - indeed, it’s used in Milton Keynes, but the intelligence is not there yet. Maybe it’s two to five years away.”

Under the plans, Orion is looking at high-speed services in 2020.

“London terminals are a problem during the day, but after the peaks and during the night it’s fine,” says Watts, when asked about capacity.

“Royal Mail insisted on the robustness of the service, and so while the principal routes are wired we need diversions for when NR carries out engineering works, which is why the bi-mode works.

“Passenger trains have lower track access, and our modelling is that passenger trains running on logistics services is cheaper than a conventional intermodal train. They have to run as Class 1s, and NR has been told that. NR is open to this.”

Congestion on the roads will increase 55% by 2040, says Watts. Using Government figures, he explains this will cost the economy £16bn per year.

“There is massive Government support for this. We have a powerful message because we are doing something,” he says.

“ROG will dwindle into insignificance eventually. It will have to do so because the market will decline.

“In five or six years’ time it will level off when the new orders end. We know that, that is why we have diversified.”

Asked if ordering the ‘93s’ was a risk, he replies: “Business is a risk. The rail industry is not as innovative as people give us credit for. We have been described as disruptors, and we like that because we are.

“These will develop other markets, and that will help us with customers. These are modern assets that are not on paper. We are restricted only by our own imagination.”

Silent Observer - 11/10/2019 13:39

Rail operations have found a sector in the market, untapped and have invested in motive power, with "go anywhere" axle loading's and appropriate coupling apparatus to move new or redundant stock, without the need for translator vans. I wish them every success in future operations.