The Office of Rail and Road is dealing with more than 80 track access applications for the next three timetable changes (in December this year and May and December 2025).

The Office of Rail and Road is dealing with more than 80 track access applications for the next three timetable changes (in December this year and May and December 2025).

It follows a call earlier this year for bids, thought to have been made to avoid the issues experienced recently on the East Coast Main Line, where controversial changes to the December 2024 timetable had to be postponed.

ORR asked for bids from those wanting access to key areas including Euston-Nuneaton, the Birmingham area including Water Orton, Birmingham-Derby, Derby-Sheffield, the Sheffield area, King’s Cross-Edinburgh and Leeds, Oxford, Gloucester and Cardiff.

It said the list was based on Network Rail’s assessment of where existing applications or aspirations interact. It added that “as capacity analysis work progresses, it is possible further locations could be identified”.

ORR has received 82 applications for the three timetable changes, with 39 from freight operators and the remaining 43 from passenger operators. Of the latter, 11 are deemed open access applications.

Proposals include a bid from Virgin Management Ltd for 68 daily services into and out of Euston, with trains from Rochdale and Preston via Manchester, as well as services from Liverpool, Birmingham and Glasgow.

Virgin (and others) appear to be bidding for spare train paths after services were cut back in the wake of the COVID pandemic.

Applications have also come from existing franchised operators, including First Trenitalia West Coast Rail Ltd, owner of Avanti West Coast. It is bidding to effectively reinstate many of the same services that Virgin wants to run.

Meanwhile, open access operator Lumo, which already runs services from Edinburgh to London King’s Cross, is applying for rights to run from Rochdale to Euston.

Grand Central has applied to run services between Bradford, Wakefield and King’s Cross, while Alliance Rail wants to link Cardiff and Edinburgh with a new direct inter-city service calling at several locations across the UK.

It is highly unlikely that all those bidding for slots on the network will be successful.

The decision will be made by ORR in conjunction with Network Rail. Both organisations will only be able to approve bids where open access adds value and capacity to the network.

Some in the industry are concerned about the impact on driver availability for the proposed new services. There are fears of drivers being lured away from existing operators, leaving them unable to operate a full timetable.

There are also issues with rolling stock, with many of the applications for long-distance services predicated on being able to secure either Class 221 Voyager trains or Class 222 Meridians, many of which are due to be replaced by new fleets in the coming years.

The ownership of bids is another issue. FirstGroup owns both Lumo and the access rights won by Grand Union from Stirling to London Euston. It also has a stake in Avanti West Coast.

Arriva, which owns CrossCountry, is applying to reinstate paths and owns Grand Central.

Virgin’s application, should it be successful, would also give it a sizeable share of the available market into London Euston.

Current open access guidance suggests that any applications need to “promote competition in the provision of rail services for the benefit of rail users”.

Open access operators make the point that planned services don’t always overlap with existing routes, mostly serving different stations and new markets.

A spokesperson for FirstGroup said: “The extensive evidence of Lumo suggests that a successful open access service helps drive up passenger numbers for all operators on any given route and provides choice to under-served markets alongside the many social, environmental, and economic benefits.”

In a statement, Arriva-owned Grand Central said: “We deliver lower fares, greater innovation, and improved performance by providing services that enhance and complement those on the wider rail network, connecting under-served communities at no additional cost to the taxpayer.”

An ORR spokesperson said: “We will consider and decide all the access applications in line with our [statutory] duties. This includes promoting improvements in performance and promoting competition where it benefits customers.”

ORR and the Competition and Markets Authority have concurrent powers, under the Railways Act, to enforce against any breaches of competition law.

Concerns have also been raised about applications lodged prior to the ORR’s initial May 20 deadline. The Wrexham, Shropshire and Midlands Railway Company (WSMR) submitted its application in March this year. It’s now thought to be waiting in the same queue as all other applications.

Ian Walters, Managing Director of SLC, which along with Alstom makes up WSMR, said: “Prior to submitting our application in March, we consulted with industry to produce a robust yet simple proposal and business plan that would add value and capacity to the network.

“We want to enter passenger operation as soon as possible, but unfortunately, our application appears to be stuck in a process with applications that are clearly more complex to determine.”

The industry is waiting for updated guidance on open access from the new government. Owing to this and the high number of applications, decisions on which applications are successful might not be announced until next spring of next year, leaving little time to ready services prior to the May timetable change.

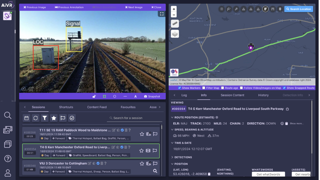

A quarter of the track access applications are from open access operators such as Lumo and Grand Central. Lumo 803004 passes Doncaster with the 1124 Edinburgh-London King’s Cross on October 23. STEVE WIDDOWSON.

Login to continue reading

Or register with RAIL to keep up-to-date with the latest news, insight and opinion.

dr bob - 02/12/2024 10:06

Running trains through Bolton (which currently has no direct London service) is a fine idea, but what's the point of it starting in Preston, which is already well served to London? There'd have to be a huge difference in fares to attract punters from a service that stops only at Wigan and Warrington. Surely a better option would be to start the train in Burnley (perhaps even at Central to save clogging the cross-pennine route), pass through Accrington, Blackburn, Darwen (these together have a population much greater than Preston, and none have a direct service to London). If the intention is to serve Chorley rather than Darwen then the Farington curve is an option.