Read the peer review for this feature.

Read the peer review for this feature.

Download the graphs for this feature.

The Invitations To Tender for the Northern and TransPennine Express franchises show that many of the ambitions set out in Greengauge 21’s research published in January 2015 are now due to be met.

It is particularly pleasing to see reference to the development of a zonal fares system included in the ITT, in addition to extra capacity, new rolling stock and strengthened support for community rail.

The overall aim of our report was to define the stepping stones needed between now and the 2020s, when major new rail investment comes on stream in the shape of Northern Hub and electrification - stepping stones that Greengauge 21 argued should form an integral part of the new Northern franchise.

In the past, the Department for Transport took the view that the Northern franchise should be managed on a minimum net cost basis. But rail demand has grown way above expectations, and Northern’s services are among the busiest in the country. The cities Northern serves are also at the core of the North’s economic hopes, which is why the Campaign for Better Transport asked Greengauge 21 to set out the case for improving the Northern franchise.

The central conclusion of our research was that the Invitation To Tender needed to reject the minimum cost approach for Northern Rail always taken in the past. The overarching aim must be to support growth in the wider economy of the North, rather than seek to reduce subsidy levels that would risk defeating the objective of rebalancing the national economy.

To achieve this wider aim, we highlighted and covered a critical set of issues for the North and the franchise:

- Why the Northern franchise matters to both the North’s and the nation’s economy.

- Why devolution matters.

- Why the picture on Northern franchise subsidy is misleading.

- Why appraisal needs to reflect the big picture on economic growth.

- Why the Northern franchise needs to be funded to address growth in demand.

- What can be achieved by modernising the rolling stock used by Northern.

- How a modernised Northern franchise will support the development of an inter-city network for the North.

- Why it is time for a better fares system across the North.

Why the Northern franchise matters

The Northern franchise is of fundamental importance to both the North’s and the nation’s economy.

Almost 25% of the country’s population live in the North, yet the region accounts for less than 20% of the nation’s Gross Value Added. Successive governments have set a priority of addressing this north-south imbalance.

Rail is the mode of transport that is growing most strongly, and it will have a key role to play in improving the economy of the North. The Northern and TransPennine franchises provide commuter services directly into almost every town and city in the North with a population above 50,000. The Northern franchise is significant in scale nationally - it operates the largest number of passenger services in terms of both trains per day and train-kms per day of any operating company in the country. And Northern and TransPennine Express together carry more passengers than the whole of the inter-city network.

The cities of the North are especially integral to the region’s economic contribution. Almost two-thirds of gross value added is created by the five core city regions in the North (Liverpool, Manchester, Sheffield, Leeds and Newcastle). Almost 75% of jobs in the knowledge-intensive sector (the fastest-growing sector in the UK economy) are in cities. And of these, 40% are in city centres that are increasingly the most productive part of the economy - supported by rail transport accessibility and affected by the number of potential workers that businesses can hire.

Why devolution matters

Rail improvements need to be fully integrated into regional and local plans. This point was recognised in strategic terms by Sir David Higgins in his Rebalancing Britain report. And it is as important between now and 2025 as it is between 2025 and 2033 when HS2 will come fully on stream - because of the need to integrate with economic development plans and prepare for HS2.

The formation of Rail North showed that the main local authorities, city regions and Combined Authorities can successfully set aside political and geographic differences and work together, taking responsibility for planning at a northern (not just a city-regional) level. This is a hugely important step, unprecedented in the almost half-century since Barbara Castle first created the PTEs to be champions of local public transport in regional cities.

The advent of Rail North and One North (and now Transport for the North) shows that local partners can successfully set aside their differences and form a broader compact to rise to this challenge and provide a clear set of realistic priorities. This trend should be encouraged - it helps make the essential connection between decisions on rail and strategic highways and other policy areas such as fostering successful economic clusters, housing and land-use planning.

In many European Union states rail provision is already a partnership between regional and national authorities, and the UK is increasingly unusual in retaining such a large proportion of rail responsibility at the centre. The trend of regional partners working under the Rail North umbrella should be encouraged - it is one of the stepping stones to the formation of an entity able to take full responsibility for specification and financing of public transport provision (as Transport for London and Transport Scotland do very successfully in their respective areas).

Such an approach would also help with planning progressive, small-scale improvements such as better journey times between the East Midlands and Yorkshire and the North West.

As a welcome step forwards, DfT has already indicated that the Northern franchise will be managed by a team based in the North, rather than in London. This team will therefore be in a position to interact more closely with stakeholders than is the case today.

Northern franchise subsidy

The widely held belief that Northern Rail is the most heavily subsidised franchise is based on shaky calculations and assumptions.

The allocation of track costs between differing train operators has been shown to disadvantage the local train operator across the Northern rail network. There is also a mismatch between access charges and the amounts actually being spent on the regional networks.

This means that the Northern Rail franchise is actually cross-subsidising other train operations, including those in the South. For example, the high level measure of subsidy allocation takes no account of important factors of cost causation, such as:

- The length of trains (Northern’s train is typically two-car or four-car in length, whereas inter-city train lengths vary between four and 11 cars, mostly towards the upper end of this range).

- The quality of access provided (fast, heavy trains are effectively charged the same as light trains).

- The attractiveness of the track slots provided - in Manchester, for example, priority has been given to slotting the Pendolino service through to Piccadilly, leading to a number of changes being made to timetables locally (including a reduction in ‘cross-Manchester’ services). Yet the Northern and the West Coast train are effectively charged the same rate per train-mile.

A review of the Northern franchise, commissioned when it was let in 2006, showed that the franchise was very efficient in terms of the way its staff and train fleet were used. Its relatively high subsidy is simply a direct consequence of the large geographic area it serves, the complex nature of its network (with no single ‘hub’ network to operate), and the fact that, with shorter trains, its revenue per train is lower than the national average.

Given also that the higher earning intercity (TransPennine Express) network in the North was separated out when the franchise was created a decade ago, it should not be a surprise that Northern’s subsidy is substantial.

Big picture on economic growth

The current approach to appraisal does not acknowledge the wider Government policy agenda of national north-south rebalancing.

While some attempts have been made to assess the GVA/employment impacts of major transport investment, the stepping stone developments and investments needed for the Northern franchise (when added together) will bring an appreciable contribution to wider strategic economic aims, particularly rebalancing the economy.

In the meantime, it is also important to be clear that the work done for the Northern Way and the Northern Hub project indicates that capacity improvements can be justified using the Department’s current guidance. Enhancements of this type help to increase the labour market pool available to employers in the northern city centres in a number of ways:

- Capacity to reduce peak period overcrowding constraints on specific trains and at stations can support the densification of jobs and residences in city centre areas.

- Improved connectivity via new linkages and/or reduced journey times can extend labour markets and open up access to job opportunities.

- Modern rolling stock can offer a better alternative and journey reliability to car commuters, also reducing road congestion.

- More attractive fares, such as ‘early bird’ commuter fares, can make access to remoter job opportunities more affordable.

Franchise needs to be funded

The simple truth is that in the decade to 2012/13, the total number of passengers increased by 150% into Leeds and Huddersfield, almost doubled into Bolton and Sheffield, and increased by 60% into Newcastle (compared with national growth of around 50%). The consequence has been significant overcrowding. Looking ahead, there is evidence to suggest that the rate of growth in rail commuting will be about 50% faster than total employment growth in city centres - this reflects people’s preference for rail travel over car use, which is increasingly affected by congestion and the cost and accessibility of car parking.

The net effect is that even a small increase in employment levels will translate into a significant impact on rail demand.

There is also clear evidence of suppressed rail demand in the North. When the new Class 185s were introduced on TransPennine Express (TPE) services in 2006, they added around a third to capacity. But by as early as 2008, TPE began lobbying DfT for extra carriages owing to passenger take-up of the extra capacity, resulting in overcrowding. A Passenger Focus survey identified high levels of passenger satisfaction with the investment in new modern and reliable trains, but passenger concerns on overcrowding re-appeared as quickly as May 2007.

All the evidence suggests that demand for rail is set to grow significantly across the North, and the Chancellor’s Autumn Statement indicated that subject to business case development, the new Northern and TransPennine franchises would deliver at least a 20% increase in capacity.

However, while that is welcome, the evidence about demand and the experience of introducing extra capacity in the North in the past suggests that demand growth will rapidly eat up such a capacity increase. The question of further timely additions to rolling stock capacity, in support of northern economic growth, therefore needs to be addressed.

Modernising rolling stock

Most of the existing Northern fleet of about 800 vehicles needs to be either refurbished or replaced by retro fitting traction equipment or diesel engines that offer reduced carbon emissions. Most (87%) of the trains are diesel and the average age is over 24 years, with few under 20 years old.

The most common type is the Pacer railbus that does not comply with European standards for accessible trains, and which under domestic law requires adaptation or replacement by 2020 at the latest. Northern also operates a large fleet of Sprinters that also do not meet accessibility standards. And only some of the fleet has customer information systems.

This combination of aged and poor-quality rolling stock is a peculiarly northern issue, which along with the capacity challenge has an impact on public satisfaction and the credibility of rail’s role in supporting the growth of the North’s cities and expanding labour markets.

The Northern franchise will most likely start with a small fleet of cascaded electric trains for the North West scheme, but this fleet will need to grow as further routes are electrified. The franchise should be let with resources for refurbishment of cascaded electrics and existing diesels, to ensure that the passenger experience is up to date and (ideally) matches the level provided by the Class 185 units used by TPE.

Experience with both Class 313s and HSTs has shown that older trains can be brought up to a high standard of passenger experience. The work that is being done on the Class 319s prior to transfer to Northern will hopefully also demonstrate this.

The rolling stock plan for the new franchise therefore needs to address the pressing current and future needs for additional capacity, refurbishment options and the approach to Pacer replacement.

Inter-city network

Development and promotion of a clear ‘Express Network for the North’, as called for in Rail North’s Long Term Rail Strategy, would help convince the market that rail is a good option for interurban travel right across the North, rather than just on a few corridors.

This would generate extra revenue, and build on the success that the current TPE franchise has had in growing volumes by using modern trains and marketing approaches.

Key elements already exist in the TPE and CrossCountry networks, but a number of links should be added - for example, the Calder Valley route better linking Blackpool/Preston/Blackburn/Rochdale with Bradford/Leeds/York/Scarborough; and Nottingham/Sheffield with Leeds and Manchester.

A better fares system

The current fares system in the North is a hodge-podge of different policies and approaches. Fares in the North are therefore not easily or widely understood.

Through their franchise agreements, Northern, TPE and East Midlands Trains should be required to work together to create an integrated structure that could be applied to all journeys across the North. Over time it could be implemented using a smartcard approach, as in London and being introduced by PTEs/Combined Authorities in the North. The new franchise provides a good opportunity to begin the process of recasting the fares structure in the North, with a number of objectives in mind:

- A zonal structure would make fares simpler. The experience of zonal fares in London is that it increases patronage and satisfaction.

- Greater consistency across the North - journeys of similar lengths should have similar fares.

- A clear and demonstrably fair basis for market segmentation (for example - workday peak, off-peak, advance purchase, railcards, group size, social discounts).

- Work towards a series of readily understandable and marketable price points. A big limitation of today’s price structure is that most flexible fares are quoted to the nearest 10p, and do not lend themselves to marketing based on easily understood price points.

However, a presumption that rail fares are too low in the North is unfounded. Once allowance is made for income levels in the North, rail fares are actually higher in the North than around London.

Conclusion

The exciting vision for the railway of 20 years’ time must not distract from the need to include in the new Northern franchise important stepping stones towards that goal.

Another ‘minimum cost’ franchise would jeopardise the future for which Government, HS2 Ltd, One North, Rail North and now Transport for the North are all planning. The need to devolve planning, modernise rolling stock, improve stations and reform fares, to start the transformation of the customer experience, is pressing.

Peer review: Pete Brunskill

Peer review: Pete Brunskill

MRTPI Principal Rail Development

Officer, Transport for Warrington

These are exciting times for railways in the north of England, and the Stepping Stones report is a timely contribution to the wider debate about improving connectivity to facilitate greater economic growth and to counterbalance an overheating London.

The Rail North area covers a resident population of 15 million, contributes 26% to national income, and importantly accounts for 60% of UK manufacturing GDP.

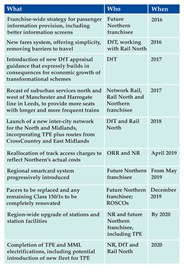

The ITTs for Northern and TransPennine were published on February 27, and represent a ‘transformational specification’ in stark contrast to the previous franchise award in 2004. Rail North has worked jointly with Government to develop this transformational specification, with a senior team of Rail North staff working closely with civil service colleagues over the last year, fully integrated with the DfT Franchise Project teams.

A Ministerial Direction was sought by the Permanent Secretary to the DfT and granted for the Northern franchise ITT, in light of the strategic case for the replacement of Pacer railbuses. This is the first time that a Ministerial Direction has been required for a rail franchising competition and reflects the national political requirement to let growth-led franchises to help deliver ‘Northern Powerhouse’ aspirations.

Stakeholders will look at the current Northern Rail network - elderly rolling stock, crowding on many routes, a confusing fares structure - and wonder how we will make the transition to the brave new world of newer (often electric) trains, greater capacity and resilience, dramatically improved passenger facilities and seamless ticketing that Transport for the North is setting out in the Northern Transport Strategy.

There is a clear narrative here, starting from the Rail North Long Term Rail Strategy, via the ITTs (and joint franchise management), and including the recent report of the North of England Electrification Task Force and work by Network Rail, to physically deliver the Northern Hub and various electrification projects leading to game-changing investment in the TransNorth Railway.

Rail North formally brings together the 29 LTAs across the region in a new partnership, to work together to plan and improve rail services for a very large and diverse part of the national economy. While this has at times been challenging, given political and geographic differences, there has been a general acceptance that working together we are stronger and better able to make the case for investment in the North.

The headline news from the ITTs is undoubtedly around rolling stock… the Pacers will be history!

While this announcement has been enthusiastically received by passengers, local politicians and the media, the equally significant point is that the next Northern operator must procure a minimum of 120 brand new additional vehicles capable of operating on non-electrified lines, and that TPE must also look to increase capacity (and later in that franchise, to secure new electric units). All retained Northern rolling stock (diesel and electric) must be fully refurbished to ‘as new’ standard. A peak hour’s capacity uplift of 30% is required across both franchises.

There will be higher frequencies on many services; later and earlier trains will run on much of the network; and as well as more Sunday services, bidders are instructed to consider running trains on Boxing Day - a long overdue requirement.

On Northern, a minimum Station Investment Fund of around £30 million is stipulated (bidders are encouraged to add to this). This will help to incentivise third party funding and links well with the greater role set out for Community Rail Partnerships. People must be at the heart of the North’s railways going forward.

Smart ticketing requirements are clearly set out in the ITTs, to cover participation in existing multi-modal ticketing schemes and in delivering a programme of ‘Smart in the North’ initiatives linked to the Transport for the North agenda to ensure comprehensive Smart coverage across the region.

This is all being taken forward in a genuine partnership with the DfT. A formal Partnership Agreement signed this month means that a joint Rail North/DfT team based in Leeds will be responsible for managing and developing the two new franchises from April 2016. Rail services in the North being run from the North - devolution in action.

The journey starts here.

Login to comment

Comments

No comments have been made yet.