Last year, Alstom’s Litchurch Lane train building factory almost shut down, before an eleventh-hour order appeared to be its saviour. One year on, Peter Plisner returns to the factory to learn more about what’s now being planned.

In this article:

Last year, Alstom’s Litchurch Lane train building factory almost shut down, before an eleventh-hour order appeared to be its saviour. One year on, Peter Plisner returns to the factory to learn more about what’s now being planned.

In this article:

- Alstom's Derby factory was saved from potential closure after securing a £370m order for ten Elizabeth line trains.

- The site is transitioning into a hybrid facility focused on both new builds and refurbishment through its new Adessia platform.

- Long-term stability hinges on consistent UK government orders and the success of Derby’s emerging ‘Rail Campus’ innovation hub.

Train manufacturer Alstom had already begun consultation on redundancy for more than a thousand workers when a contract worth £370 million to build ten trains for London's Elizabeth line was finally signed.

It was a nail-biting time for the site’s management, which had warned that unless an order from the UK government was forthcoming, the whole site would have to close - ending hundreds of years of train building at the factory, and support for around 15,000 jobs both there and in the wider supply chain.

Alstom had made it clear that without the Elizabeth line order, it had “no meaningful workload’ until at least the middle of 2026 - a situation which it said was “totally unsustainable”.

After several years building and delivering hundreds of its Aventra electric multiple units, new UK orders had dried up with nothing new on the horizon.

Alstom had been in talks with the Department for Transport about when a new pipeline of orders would materialise. The company was working on the theory that by 2030, the UK would have the second largest potential market (behind Germany) for commuter trains, as carriages built in the 1990s would need replacing.

The question was: how long could Alstom maintain the capacity at the Derby site that would clearly be needed going forward, with little or no orders actually on its books?

The gap, the company had estimated, was between 18 months and two years.

Alstom wasn’t looking for financial support from the government, but some of the existing Aventra contracts - including South Western Railway and the Elizabeth line - had the ability to be extended with an order for additional units. There were also talks about bringing some refurbishment contracts to the Derby site.

During the talks, Alstom also offered the possibility of increasing Derby’s export capacity. It had already completed an order for the Cairo Monorail, but plans were also being worked up for the next generation of commuter product.

The ‘Adessia’ platform is due to replace the decade-old Aventra platform. And during talks with the government, the company indicated that it might want to make Derby the global home of Adessia, with the factory hosting the design, engineering and development.

It’s an important platform for the company. The move would secure not only long-term investment, but also thousands of jobs.

After months of talks, in June 2024 it was finally announced that Alstom had won a follow-on order for the Elizabeth line - ten Aventra trains, with a value of £370m. The new units will join the line’s 70-strong fleet of Class 345s that are already carrying passengers under central London and beyond.

That order was followed two months later by a £60m contract to refurbish 312 carriages on CrossCountry’s Class 220 and ‘221’ Voyager and Super Voyagers.

Trains will be fitted with new carpets, improved lighting, and a new passenger counting system.

Sustainability will be at the heart of the refurbishment. The Voyagers’ new seats will be at least 95% recyclable and 98% recoverable, while lighter materials used throughout the trains will help reduce fuel and carbon emissions.

Now, just over six months later, the Derby site is mobilising to start production of the new trains in July, as well as the refurbishment work.

“Bearing in mind the [Elizabeth line] order was placed about eight months ago, the latest mobilisation involves sorting out the pre-assembly, with jigs and the production line reset to align to that order,” says Alstom Customer Director Christine Fernandes..

“There is of course some engineering involved, because obviously it’s been quite a while since the last order, so there are modifications that will need to be updated and included in the new revision of these units.”

But the Elizabeth line and CrossCountry orders will not fill up the Litchurch Lane site, and the company has had to make a decision to reduce the number of production lines.

Fernandes explains: “We’ve had to rationalise the footprint of Derby, because it’s a very old site and a very large site. So, we’ve reduced the production lines from six to three, to align with the new vision of what we anticipate the smooth workflow will be - if we have transparency within the market.”

What Alstom and Derby needs is some certainty from the government.

Fernandes adds: “We, as a supplier, need some transparency - and not just a two-year look ahead, but longer term, perhaps five or ten years. That gives us some visibility of where the opportunities are.

“I think the opportunities need to be probably longer, in terms of some of the maintenance opportunities. They need to be longer than some of the franchises.

“We need to mobilise and look at our supply chain in terms of offering the best value for money. If we have a longer period of time to have that knowledge, we can add value in that.”

But there are more changes at Derby, and the recent refurbishment contract from CrossCountry is a clue to something else that’s happening.

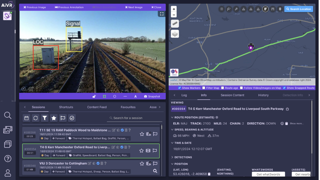

Alstom has decided to make Litchurch Lane a hybrid site. As well as building new trains, it’s switching to Asset Lifecycle Management (ALM) work.

“That will involve refurbishment and upgrading of existing fleets, so more on the service side of business,” says Fernandes.

And that’s expected to be a big market as more companies choose extended life, rather than renewal of trains.

“There is a market out there, in terms of cascading of trains,” says Fernandes.

“If the Department for Transport and Great British Railways are looking at managing their boom and bust, there will be a consistent workflow. I think cascading and the opportunity to refurbish existing fleets will be there.

“We do have other sites, obviously. We have our Widnes facility, which is specifically a refurbishment site, so we'’re mindful we have another mouth to feed there. We also have the Ilford site, which does upgrade and refurbishment as well.”

Widnes has recently completed the refurbishment of the Avanti West Coast ’s Class 390 Pendolinos, while last year Ilford secured a contract for paint and repair of c2c’s Class 357 fleet.

At Derby, new builds going forward will be concentrated on the ‘Adessia’ platform.

It’s seen as a combination of the best parts of the legacy that is Aventra and Alstom’s X’trapolis platform. Both are high-capacity commuter trains designed for regional and suburban markets. X’trapolis has already been sold to places such as South Africa, Ireland and Australia.

Fernandes says: “Adessia will be a global platform, but localised within a region. So, in the UK it’s going to be quite a bespoke platform. We’ve just signed contracts in America and in Germany for other X’trapolis. It is a global platform, but all of the engineering has been done in situ here in Derby, with localisations obviously in the local areas.”

Engineering means all of the designs and calculations that are related to the mechanics and the functionality of the train. It also includes the industrialisation of the design, and then the subsequent manufacturing of orders for UK and some parts of Europe.

Alstom is already bidding for work using the new platform. Two new-build opportunities with Southeastern and TransPennine Express have been bid on the basis of localised versions of the Adessia train, and there’s expected to be an opportunity to bid with the platform for the new trains for Northern.

Unlike the Aventra product, Adessia will have the ability to be delivered as a bi-mode train with batteries if required.

“We're looking at charging stations as an alternative. It’s cheaper than full electrification,” says Fernandes.

There is currently plenty of talk about discontinuous electrification. The new East West Rail route is the latest to promote the idea, in its recent consultation. Alstom is clearly mindful of the way things might go, and is working on a variety of ‘packages’ as part of its new Adessia offering.

“We'’re looking at introducing charging points, so that trains can run on battery, but then be charged at an intermediate station,” says Fernandes.

“The package that we offer is always driven by the customer requirements within the tender. So, while we can offer a solution and demonstrate how we can add value for money, ultimately our product offering is driven by the requirements of the competition and the need to provide a compliant bid.”

In addition, the company (along with Hitachi) has won the contract to design and build the trains that will run on HS2.

Fernandes explains: “Hitachi will provide the body shells, so they will come to site painted and watertight. Hitachi is actually doing the design and engineering around the traction system, and that again will be shipped to our site. We’ve got our bogies being built in Crewe, and they will also be brought to Derby and then the overall assembly will be set up here.”

Timescales for that order are still a bit fluid, but it’s understood that engineering work has already started.

“Hitachi will be doing pre-mobilisation starting next year and then the following year the body shells will be coming to our site for us to assemble, so it should be around 2027 that we start manufacturing,” says Fernandes.

What about rail reforms? Is the company fearful of what might be coming and the impact that might have on train building contracts?

Under privatisation, innovation was key. It was all about increasing passenger numbers, and new trains was part of that drive. Many are concerned that renationalisation is about reducing the amount of spending going into the railways.

Fernandes says: “I think this government has made a pledge that it believes in the ethos of rail travel. And in terms of where we see the market, some of the fleets are life-expired, and the government will need to do something about those fleets.

“A train is meant to have a life of about 25 to 35 years and some of them, like the HSTs, were around for prolonged periods of time.”

Because of that, Alstom doesn’t anticipate there being a problem. Also, despite recent concerns over open access, there could still be privately financed opportunities.

Fernandes says: “Even though we’re going to go back to a nationalised template, there will still be the need for private investment. That will probably drive the innovation and impetus in terms of getting deals done.”

In addition to rationalising the Derby site and reducing the number of production lines, Alstom has other plans for Litchurch Lane.

Part of the story is to bring in third-party suppliers and have them co-located on the site in conjunction with the developing ‘Rail Campus Derby’.

Fernandes explains: “We did have one supplier on site that was doing all of our electrical work. But they actually folded, I think, through obviously the lack of work. That was one of the casualties. They were effectively working here on a contract with us.

“But we’re now thinking about non-contracted companies being onsite, and again helping to consolidate our site and reducing the size of our footprint.”

It’s still early days when it comes to the ‘Rail Campus Derby’, which was launched last year by then-Transport Secretary Louise Haigh.

At the time, she said: “Derby is already a hub for rail with the largest concentration of innovation and expertise in Europe, and I am delighted to see how the local council plans to expand this even further through a new Rail Campus.

“The railways are at the centre of our plans for change, and I look forward to seeing how the Campus will lead to greater innovation, growth and collaboration, benefiting not only our rail network but the wider economy, too.

Alstom sees itself as the heart of the rail campus, as well as it helping to keep the Litchurch Lane site open and viable.

Fernandes says: “It’s had two of its lives burned, hasn’t it, in terms of closing and then opening? And this will bolster the longevity of Derby.

“There were other opportunities that we could look at in terms of mutual training. We have a training academy on site in Derby, and a longer-term aspiration is to have that as part of an overall hub for the rail industry to utilise. We’d like to think about having an innovation site on the campus here in Derby.”

Following the decision to site the new Great British Railways HQ in Derby, the city appears to be regaining its crown as the centre of the UK rail industry.

It’s hoped that the new rail campus will not only preserve the city’s rail heritage, but also be a catalyst for future economic growth, bringing together all aspects of the railway industry and attracting more investment.

The Alstom factory is expected to play a major role in that future, but recent events and a lack of orders clearly put that aspiration under threat.

However, with the new Elizabeth line and CrossCountry orders, it has gained the breathing space it needs, while the arrival of the Adessia platform should help to ensure continued orders for new rolling stock from both the UK and Europe.

What a difference a year makes!

Login to continue reading

Or register with RAIL to keep up-to-date with the latest news, insight and opinion.

Login to comment

Comments

No comments have been made yet.