Read the peer reviews for this feature.

Read the peer reviews for this feature.

Download the graphs for this feature.

The growth in passenger numbers and the need to replace rolling stock with unsuitable crashworthiness standards, has led to the delivery of more than 6,000 new vehicles since privatisation. All of these are operated either as electric or diesel-powered units. No new locomotive-hauled coaching stock has been introduced, although this will change when Spain’s CAF builds the proposed new sleeping cars for Scotland’s Caledonian Sleeper.

The structure of these acquisitions has been that the majority of vehicles are specified either by Government agencies or by train operating companies and then purchased from manufacturers by leasing companies, who then hire the trains to the TOCs for operational use.

As public bodies or franchises/concessions granted by Government agencies, European procurement rules require open market tendering throughout the European Union.

The limitations of the UK loading gauge have restricted market entrants and the fleet additions have been concentrated on a limited number of manufacturers. This has resulted in large orders for a relatively few number of vehicle designs.

In most situations, the relatively short contract periods held by the franchised operators has resulted in the rolling stock being considered as a franchise asset, with a future concession holder required to continue the lease. This enables funders to have confidence in the use of the vehicles over a significant part of their design life.

Additionally, a small number of trains have been purchased outright, in particular by Heathrow Express.

A growing trend has been to require manufacturers to organise the maintenance of the rolling stock, with the aim of optimising fleet availability and the associated management of heavy overhauls and provision of spare parts.

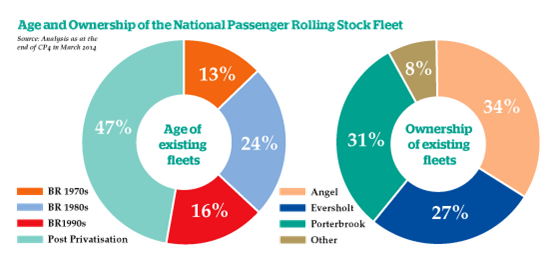

In terms of the age profile, all 47% of vehicles in current use have entered service in the post-privatisation period. The remainder was inherited from BR - 13% of the fleet dates from the 1970s, 24% from the 1980s, and 16% from the 1990s.

The three original rolling stock companies established when the new industry structure came into being remain the predominant owners, with Angel Trains having a 34% market share, Porterbrook Leasing 31% and Eversholt Rail 27%.

In evaluating the make-up of rolling stock acquisitions since the break-up of BR, the main elements have been the replacement of Mk 1 rolling stock operated over the former Southern Region third rail electrified network, the replacement of obsolete locomotive-hauled assets and the need to cater for growth. The latter has required rolling stock capacity to be increased on many routes, by the acquisition of new vehicles and by the retention and refurbishment of older equipment.

There has been very little new electrification, apart from the re-opening of lines in Scotland and the commissioning of the first phase of the North West triangle project. However, this is now changing, with the advent of a national programme for installing overhead line catenary.

Traffic growth outside the London area has required enhancement of the DMU fleet, and there has been a substantial build of the Class 170 Turbostar type (by Bombardier at Derby) to provide vehicles for a range of operators.

Porterbrook was closely involved with the development of the fleet, and ordered trains without a defined customer in the belief that the market would find a need for the trains. It is a great shame that there has not been more of this speculative approach - it would have resolved the lack of capacity that is now evident for a number of rolling stock types.

Rail Value for Money study

In Sir Roy McNulty’s Rail Value for Money study in 2011, concerns were expressed about poor productivity resulting from the many types of rolling stock in use, with the inference that standardisation could reduce costs.

The main reason for the diversity in equipment is not poor quality strategy, rather the policy of competitive tendering. This broke the model of a railway that had been based on integrated workshops where there was design evolution, rather than starting with a blank piece of paper.

Having said that, the different manufacturers have provided much needed innovation, while there has also been much change in the requirements of technical and environmental standards. The examples here include the judgement that greater crashworthiness is justified, that running gear should be designed to reduce track wear and that emissions must be curtailed.

The era of competitive tendering has seen the emergence of standard types - Turbostar and Electrostar trains from Bombardier, the Siemens family of Desiro units, and more recently the present and future Hitachi equipment.

One legitimate criticism is the operational difficulty caused by the use of different coupling systems. This has resulted in severe delays when the need arises for failed trains to be assisted by a following service where couplers are not compatible.

Standardisation of rolling stock

When British Railways was established after nationalisation in 1948, there was a belief that standardisation could reduce operating costs, although there were many constraints in the post-war economy, such as steel being in short supply. It was not until 1951 that the first of the steel-bodied Mk 1 standard vehicles appeared, and restrictions in the allocation of steel for railway purposes meant deliveries were far below that expected.

The procurement process as such was that the Railway Executive made an annual bid for its allocation of steel and investment funding from the Treasury. Passenger coach construction fared badly because other industries had priority (electricity generation, for example), and within the railway budget the urgent need to replace obsolete water coal wagons with standard 16-ton 4W vehicles was judged more important.

For the coaches, a standard gauge restriction had been established that resulted in a vehicle body that was 63ft 6in (19.36 metres) in length with a maximum width of 9ft (2.74 metres). To overcome restrictions where there was significant curvature, there was also a standard length of 57ft (17.37 metres) that was used for rolling stock intended for suburban routes.

The frames and running gear adopted the best practices of the pre-Nationalisation ‘Big Four’ companies. Vacuum brakes and steam heating were retained, despite development of pressure-heated and ventilated rolling stock by the London & North Eastern Railway (LNER). The judgement was that low construction costs should be the priority over higher amenity standards, because revenue opportunities were threatened by the growth in private road transport.

By the mid-1950s the steel shortage had eased and a policy of deregulation combined with national economic growth allowed greater investment funds to be made available, which led to the railway modernisation programme of 1955. Electrification plans were now favoured, although in 1957 there was an attempt to improve the standard Mk 1 coach design that was very much an austerity product.

There had been continuing doubts as to whether investment in higher quality coaches would bring increased revenue, but evidence was growing that this would indeed prove to be the case, as the services provided on main line routes improved following the introduction of diesel traction and higher track speeds.

The effect of an objective to provide a better journey experience led to BR launching an experimental train: described as XP64, it was refined to form the Mk 2 standard design that went into production in 1964. Later variants of this type were fully air-conditioned.

The Mk 2 design resolved the severe corrosion issues experienced with the Mk 1 type, where the base of the body was joined to the underframe, by substituting an integral construction. There was a small increase in length to 64ft 6in (19.66 metres), and close to 1,900 vehicles were built by BR at Derby. Construction ended in 1975 as the next generation of Mk 3 vehicles began delivery.

A substantial fleet of electric multiple units was built to the Mk 1 design, which at the time of its introduction had superior crashworthiness characteristics than earlier types, that were often of wooden construction. The Clapham accident in 1988 showed that in the worst circumstances the coaches represented a collision damage risk, but the subsequent inquiry found that they were not inherently unsafe and continued operation was permitted.

It was not until 2002 that the safety authority, the Health & Safety Executive, judged that operations by slam-door Mk 1-type coaches could not continue after the end of 2004, given the improved protection now offered by more modern vehicles in the event of a collision.

Despite their longevity, Mk 1 coaches remain popular for charter travel, where the advent of the Train Protection and Warning System has reduced collision risk and allowed the vehicles to remain in use. Many Mk 2 vehicles that are less favoured for charter work, because they are air-conditioned and require more modern traction to be used for haulage, have been exported. More than 140 of these coaches are now in use in New Zealand, for example.

Evolution to High Speed operation

It is remarkable that the Mk 3 BR carriage design conceived more than 40 years ago as a standard vehicle for 125mph operation, whether in the fixed formation High Speed Trains or for conventional locomotive haulage, remains at the forefront of the product offered by long-distance operators today.

And the Mk 3 is destined to remain in service for at least another decade, given the decision by Abellio to refurbish a substantial number of IC 125 trainsets for use on ScotRail inter-urban services in the years to 2025.

These vehicles represent the swansong of the BR era, whereby vehicles were specified, designed, built and paid for within an integrated organisation and where procurement decisions remained based on application for financial authority from the Government.

The main characteristic that differentiated the Mk 3 from earlier types was the length of the coach - 75ft (23 metres). Although it was always intended that the vehicles would be confined to the more important long-distance routes over time, the dimensions have not proved unduly restrictive in terms of geographic availability.

And the popularity of the type is a reflection of their excellent ride, which is due to the use of hydraulic dampers in addition to their coil-spring primary suspension. Production continued until 1988 and a lower-speed shortened version was used for large numbers of electric units.

It can thus be seen that there was a continued lineage between 1951 and 1988, as the first Mk 2 vehicles were operated within Mk 1 rolling stock formations and had compatible draw gear. As the newer vehicles were developed with air brakes, operational compatibility was maintained by converting Mk 1 coaches with air brakes.

Similarly, as Mk 3 vehicles came into production they could be marshalled with Mk 2s, as there was draw gear and electrical compatibility, although the High Speed Train fleet was conceived as a standalone formation and did not have electrical compatibility with the earlier vehicles of the type built for locomotive-hauled operations.

For the rolling stock required in the late 1980s for the East Coast Main Line electrification, very different protocols were in force.

It had been decided in 1983 that vehicle requirements would become part of a competitive tendering process, in the belief that this would be a spur to reduced prices and greater manufacturing efficiency. This resulted in a move away from consistency with previous standards and by 1987 private sector contractors had secured more than 50% of rolling stock construction orders, with the workshops owned by BR now managed as a distinct subsidiary.

This led to the decision to sell the six British Rail Engineering Limited workshops that were involved in new construction at Crewe, Derby, York, Doncaster (wagon works), Horwich (foundry) and Swindon. Only Derby (owned by Bombardier) now remains in the rolling stock construction business.

The contract to construct the East Coast vehicles that were designated Mk 4 was awarded to Metro-Cammell and 314 vehicles were built between 1989 and 1992. The original specification required 140mph running with an ability to tilt by up to 6%, and as a result Swiss SIG BT41 bogies were selected, rather than a BREL design that would have continued the ride characteristics associated with the Mk 3 vehicles.

When introduced, the ride of coaches proved to be inferior to the Mk 3 and so modifications were made to the suspension system, in particular to improve damping between the vehicles. Disabled access was another priority of the design, so the door entrances were enlarged to allow a more generous turning circle for a wheelchair. The vestibule environment was improved with carpeted walls, better lighting, sealed gangways and carriage doors.

The trains will have a shorter life than the HSTs they replaced, unless owner Eversholt Rail can refresh the product for use in other suitable operating environments when their ECML working lives end with the introduction of Hitachi’s IEP.

Replacement High Speed Trains

After three decades of service since 1976, the need for HST replacement was apparent, at least a decade ago, although the trains remained popular in terms of the product offered.

Initially it was seen as providing what could be described as HST2 - but the urgency went out of the project when the overhaul of power cars with new MTU engines took place (although East Midlands Trains opted for the Paxman V185 power pack in its engine replacement programme). It was also realised that the popular Mk 3 coaches could be retained in service, although ultimately modification would be required to improve accessibility and to install controlled emission toilets.

In the breathing space created before a replacement decision was needed, the project was taken over by the DfT, during a period when the Government was exercising more direct control over not only franchised operations but also rolling stock procurement. The notion of developing a replacement diesel-powered HST was dropped in favour of a wider initiative described as the Intercity Express Programme.

Decisions had to be made about whether the trains should use distributed power with below-floor engines in place of power cars - the decision to adopt this form of traction reflects the greater number of passengers that can be conveyed in a given length of train.

The Government also sought to fulfil a high-level objective to create a new assembly plant where the trains could be built. It achieved this by awarding the contract to Agility Trains, a consortium that includes Hitachi, which is building a new train assembly facility at Newton Aycliffe, in County Durham. It also moved away from financing by the ROSCOs, in an attempt to widen the competitive nature of the market in rail finance by specifying in the procurement process that the manufacturer must organise the finance required to build the fleet.

This turned out to be the source of considerable delay - while the nature of the investment risk is understood by the ROSCOs, that has not necessarily been the case for other sources of funds. As a result, there is little likelihood that financing costs will be reduced.

While the make-up of the order for what is now known as the Hitachi Super Express was debated, the Government decided to embark on a major programme of electrification, as part of a job creation exercise to mitigate the effect that the banking crisis of 2008 had on national economic output.

As a result, the IEP trains will have a much greater element of electric trainsets, although bi-mode units will be equipped with the capability to reach destinations that are not located on the electrified network.

Electric multiple units

The great bulk of electrified lines inherited by BR comprised the Southern Railway network that used the third rail current collection system.

And for some years after nationalisation, activity was confined to finishing schemes (such as the Woodhead and Shenfield projects) that had been started by the LNER but held up during wartime.

The rolling stock provided for the Shenfield services was built to a pre-war design by private contractors, and equipped with English Electric traction equipment. When first built, the trains were operated using 1,500V direct current (DC) overhead line collection, but from 1960 they were converted to the AC format.

The first units equipped to use the newly standard 25kV alternating current (AC) overhead power line system were delivered in 1958 for use on the London, Tilbury & Southend lines, although initially they were allocated to services between Liverpool Street to Southend Victoria as this was converted DC to AC power. They had been built at the BR workshops at Doncaster and York, following the standard Mk 1 coaching stock design with electrical equipment supplied by English Electric.

In Scotland, electrification of North Clyde and Cathcart circle routes in 1960 saw the introduction of the striking ‘blue trains’ that were deliberately liveried to stand out from the down-at-heel steam-hauled services they replaced.

The three-car units were manufactured locally by Pressed Steel, and were based on the Mk 1 bodyshell design with electrical components made by Metropolitan-Vickers. They had many features that made them ‘state of the art’ at the time of their introduction, including the use of pneumatically operated sliding passenger doors - the only Mk 1 based EMU to use this feature.

Of note was the introduction in 1962 of the first 100mph units for Clacton services, built by BR at York. The traction motors were supplied by GEC and Commonwealth bogies were fitted to reflect the higher speed required.

In 1963, the first EMU based on the Mk 2 bodyshell was introduced. They were built at Derby using English Electric traction equipment for use on commuter services from London Euston, but were restricted to 75mph maximum speed.

Similar units were constructed at York, with the final type being introduced in 1976 for the newly electrified Great Northern suburban services, with speed upgraded to 90mph. This was the last unit class to be built with slam doors.

Also in 1976, a type that remains in the current-day fleet was introduced and used as a standard inner suburban train. These were the first second-generation EMUs to be constructed, and featured an aluminium alloy body. Dual-voltage capability was available as required on the GN route to Moorgate. Another innovation was that they were the first units in Britain to have multi-function Tightlock couplers, allowing coupling and the connection of control electric and air supplies to be carried out from the cab.

From 1981, the Mk 3 bodyshell was used for both AC and DC units, although the length was reduced to 19.83 metres. A mixture of GEC and Brush electrical equipment was supplied, with some recovery of previously used equipment for third rail vehicles. The trains were constructed at York, and remain in service today. Common features are Tightlock couplers, disc brakes and sliding doors, although the vehicles have dated as no air-conditioning was fitted.

The final AC electric type specified by BR was in line with the policy of encouraging alternative suppliers, with a small fleet of Class 323 units built by Hunslet TPL in 1992 for use in the West Midlands and Greater Manchester. The West Yorkshire Passenger Transport Executive had also wanted to use the type on the newly electrified Airedale lines, but BR did not secure authority from the DfT.

British Railways inherited a significant fleet of electric units powered by the DC system. As these units became due for replacement, the standard Mk 1 vehicle formed the basis of the rolling stock built, including that for newly electrified routes such as the major Kent Coast scheme (310 miles equipped by 1962). Motor coaches had two 250hp English Electric traction motors that were used through the Mk 1 fleet.

The Bournemouth electrification completed in 1966 entailed most of the rolling stock being sourced from locomotive-hauled Mk 1 coaches dating from 1951. But by 1986 the vehicles were in poor condition and a fleet of new units was authorised based on the Mk 3 bodyshell. However, the ever-thrifty Southern Railway inheritance resulted in the traction equipment from the motor coaches of the original sets being re-used.

Network SouthEast was created as a result of the BR Sector reforms in 1982. By now there was an urgent need to replace ageing inner suburban vehicles, for which the Networker was designed as a replacement. In 1988 an Invitation To Tender was issued that covered a requirement for 710 units and by 1994 a total of 147 sets had been delivered for Kent suburban services. An express version was also developed, and today these are allocated to King’s Cross outer suburban workings.

There was a change from the then standard use of GEC (previously English Electric) traction motors, with the unit construction divided between BREL at York and GEC Alstom. Former sets used Brush electrical equipment.

There was a long delay before the new privately owned train operating companies were ready to order new rolling stock, but for electric units products were available from Adtranz (later Bombardier), Alstom and overseas builders such as CAF and Siemens.

Bombardier acquired Derby’s Litchurch Lane works from Adtranz in 2001, and was offering the Turbostar and Electrostar product as well a metro design it had developed for use on the London Underground. The Electrostar had been ordered in quantity by the LTS, Southern and South Eastern franchises.

Alstom had acquired the Metro-Cammell works at Washwood Heath, Birmingham, as a platform to bid for the construction of rolling stock in Britain and secured an important order from Angel Trains (on behalf of Virgin) to construct the Pendolino fleet for West Coast operations. It also supplied a limited number of third rail units for Gatwick Express and South West Trains - in both cases financed by Porterbrook.

At one time it looked as though Alstom would challenge Bombardier in the EMU market, with its Juniper product. But after the problematic performance of these Class 458 trains supplied to South West Trains in 1998, when the time came to replace the Mk 1 slam door fleet the operator switched its supplier to Siemens.

This was a blow from which Alstom operations in the UK did not recover and the Metro-Cammell plant it had acquired in 1989 was closed in 2005 after construction of the Class 390 Pendolinos was completed in the UK.

Siemens has a long relationship of trading with UK railway companies and in an ongoing and successful partnership with the Spanish builder CAF its electrical equipment was used for trains ordered by Heathrow Express and by the then Northern Spirit franchise to replace elderly rolling stock on the Airedale routes. The Heathrow Express units were purchased outright by airport owner BAA, while Angel Trains provided finance for the Airedale vehicles.

Angel Trains developed a partnership with Siemens to exploit the UK market, and the manufacturer’s four-car AC Desiro type was chosen by the Great Eastern franchise to replace units used on longer-distance services to Clacton. The type also attracted an order from Heathrow Express for use on the Airport Connect stopping service (again a direct purchase).

The need for higher-performance rolling stock to conform to West Coast Main Line pathing requirements resulted in more orders for the Class 350 Desiros, funded by Angel Trains.

Thirty sets were acquired in 2005, and these were soon enhanced by a further 37 sets, this time financed by Porterbrook and delivered in 2009. The enhanced fleet was required to provide rolling stock for West Coast semi-fast services that were transferred to the London Midland franchise.

This year, a further 20 sets were ordered for delivery in response to traffic growth, and to provide rolling stock for the newly electrified TransPennine Express between Manchester Airport and Edinburgh/Glasgow. The latter vehicles have been upgraded to offer 110mph maximum speed.

The decision to replace Mk 1 rolling stock on routes operated by South West Trains did not leave a long timeframe to acquire new trains. As a result, the Siemens Desiro type was again chosen, and the fleet replacement programme was completed in 2006. In total, Angel Trains funded 845 coaches, comprising 45 five-car express units and 155 four-car outer suburban sets.

Another significant Desiro order was secured from ScotRail, with the backing of Transport Scotland. Thirty-eight three-car and four-car 100mph units were delivered for introduction into service in 2010, with funding from Eversholt Rail.

The provision of 1,140 coaches required for upgraded Thameslink services proved controversial, after the tendering process resulted in the contract being awarded to Siemens.

There were questions about whether the evaluation of the bids reflected the societal cost of Britain’s sole passenger carriage manufacturer (Bombardier) losing the order. Subsequently, it was revealed that the need to provide finance to purchase the rolling stock (for lease to the Thameslink operating company) had put Bombardier at a disadvantage, because Siemens had a much stronger credit rating and could therefore raise finance more cheaply.

But the decision looked at odds with common sense from a UK trading perspective, and it resulted in a scramble to find orders for further Class 377 units to prevent the Derby works from closing. It also put down a marker about the procurement award for the Crossrail fleet of 585 vehicles, which was duly placed with Bombardier in early 2014.

Earlier, Transport for London had dropped plans that required the vehicles to be financed by the manufacturer, and instead secured a £500 million corporate loan facility with the European Investment Bank.

Hitachi has made a successful entry into the UK market, with lease finance provided by Eversholt. In 2009, it completed the delivery of 29 six-car high-speed units for the Southeastern franchise, capable of 140mph maximum speed to provide rolling stock for the HS1 domestic services.

Also in 2009, the DfT chose the Agility Trains consortium (comprising Barclays Private Equity, Hitachi and John Laing) as the supplier of replacement HSTs. An attraction was that 70% of the contract value would be placed in the UK and that Hitachi would construct an assembly plant at Newton Aycliffe.

The specification for the rolling stock changed following the decision to electrify the Great Western Main Line, although the bi-mode capability has been retained to enable trains to run to destinations that are not equipped with overhead wiring.

The order for the Class 800 bi-mode trainsets will provide 13 nine-car and ten five-car vehicles for East Coast operations and 36 five-car units for the Great Western. The allocation of the electric-only Class 801 type is 30 nine-car and 12 five-car for East Coast and 21 nine-car for Great Western. There is flexibility in the conversion of bi-mode formations to electric, but only if enhanced route electrification occurs. The order totals 866 cars that are to 26m long with a speed capability of 125mph.

Hitachi has also been successful with a new product described as the AT200 Commuter, designed with 23m coaches and a maximum speed of 100mph.

The type has been chosen by Abellio as part of its successful bid to operate the ScotRail franchise from April 2015. Seventy units will be supplied (with an option for a further ten), formed as 46 three-car and 24 four-car trains. They will run on the newly electrified Edinburgh-Glasgow line via Falkirk, as well as on the Stirling-Alloa-Dunblane lines, and will be cleared to run throughout the wider network, which is currently being electrified.

Diesel multiple units

The initial attraction of a diesel-powered train was the realisation that thermal efficiency would reduce operating costs, as well as the capacity for driver only operation (DOO).

A prototype had been demonstrated as early as 1931, built by the Tyneside firm of Armstrong Whitworth in the form of a diesel electric multiple unit. But the LNER showed little enthusiasm to extend the project, despite statistics that showed operating costs of 6.5p per mile compared with steam railcar operations of 9.1p, and a traffic availability of 86% compared with 70% for steam.

Elsewhere a diesel mechanical format was favoured and the Great Western Railway received a first unit in 1934, powered by standard AEC bus engines. The design was steadily improved and twin-engine motor coaches soon allowed 70mph running on routes such as Birmingham-Cardiff. Statistics analysed in 1950 showed that a two-car set with 124 seats had an operating costs of 11.9p per train mile, compared with steam operations with a comparable two-coach formation of 14.7p.

Initially, BR had little enthusiasm for the use of diesel power. One of the issues of the day was the need to import oil, rather than continuing to use coal produced in the UK. But after a challenge by British Transport Commission members (who today might be seen as the non-executive directors), an investigation was launched that resulted in the 1951 Harrington report.

It concluded that diesel railcars had the advantage of lower operating costs, better availability, quick turn-round, rapid acceleration and the appeal of being a modern, clean and pleasing vehicle in which to travel. It might also have added the opportunity to simplify infrastructure, which latterly has contributed significantly to the retention of many branch lines.

The first BR-designed DMUs followed the principle of lightweight construction and were introduced from 1954 using the 125hp AEC power trains originally used for the GWR rolling stock. More than 200 vehicles were constructed at Derby, before the adoption of a more far-reaching modernisation plan that required the use of other BR works and private sector manufacturers.

By the time Sector Management was introduced in 1982, these first-generation DMUs were life-expired and urgent decisions were needed about replacement. This was an era when the DfT was pressing for bus substitution on many secondary and rural routes, to which the response was the now infamous but low-cost two-axle Pacer unit. Although roundly criticised for its facilities and ride quality, it remains in service today and provides the backbone of rolling stock needs for many services with poor financial returns.

Four classes of Pacer units were delivered, reflecting the policy of procuring from a range of constructors. Vehicles were supplied by BREL at Derby (with Leyland and Alexander bus bodywork), and by Andrew Barclay (also with Alexander bus bodywork). All vehicles were 15.45m long. Introduction started in 1985 and all vehicles were powered by a 225hp engine that produced a maximum speed of 75mph.

The first of the Sprinter range of vehicles entered service in 1985. These were more conventional units with bogies and were initially built by BREL at York. Maximum speed remained at 75mph, but the Cummins power unit was up-rated to 285hp.

Two builds followed in 1988, designated Super Sprinter because they were longer 23m vehicles (compared with the earlier 19.7m length). These came from Leyland Bus and Metro-Cammell, although they also have the 285hp Cummins engine. Most of the Leyland units were subsequently rebuilt as single-car trains for use on lightly used lines.

Between 1989 and 1992, BREL at Derby built the fleet of 90mph Super Express Sprinters, with engines upgraded to 350hp and 400hp. These 22m vehicles operate over a wide range of the regional network and form the core of the ScotRail diesel-powered fleet. A sub-class of the type is allocated to South West Trains, having been converted at Rosyth Dockyard for use on services between Waterloo and Exeter.

The next series of vehicles, specified by Network SouthEast, had similar characteristics to the Networker electric units.

Described as Network Turbos, they were built by BREL at York in 1991/92, to operate Chiltern and Great Western local services in the London area at either 75mph or 90mph. The vehicles are 23.5m long, and with a width of 2.81m they require a larger loading gauge (made possible by the infrastructure characteristics of the routes, but with the drawback that they cannot be readily used elsewhere).

The Class 168 Clubman, which was the precursor of the large fleet of Class 170 units, was built by Adtranz at Derby and powered by an MTU engine rated at 422hp with a maximum speed of 100mph. They were introduced in 1998, at the same time as the production of Class 170 vehicles started, and are fully air-conditioned.

The Class 170 was designed as a train that had route availability for the national network, and was therefore narrower (at 2.69m) than the Turbos. The detailed design involved Porterbrook, which subsequently owned the fleet - with the exception of a small number of vehicles owned by Eversholt Rail.

An upgraded Class 172 design featured a 483hp MTU power unit to provide better acceleration, but the order book was curtailed after the DfT cancelled a plan to enhance the diesel unit fleet by 202 vehicles (to respond to traffic growth), given the intention to electrify a number of routes.

A great advantage of the fleet of diesel units is that they have a common coupling system, with the exception of a handful of units that have been fitted with Dellner equipment and designated as Class 171 as a result. These trains are operated by Southern, and couplers are compatible with the electric unit fleet.

With new rolling stock required by the longer-distance operators, to enhance capacity and to replace locomotive-hauled rolling stock operated by Virgin CrossCountry, two designs for a 125mph diesel-powered unit emerged.

Alstom delivered Class 180 Adelante trains in 2001 and the Class 220 Voyager series (constructed by Bombardier, mainly at Bruges in Belgium) between 2000 and 2005.

All of the 125mph units use the same engine (supplied by Cummins), with some variations in the power output at either 700hp or 750hp. There the similarities end, because Great Western specified a hydraulic transmission, whereas the Bombardier vehicles have electric traction motors.

At the same time as the Class 180 Adelante units were acquired, Great Western Holdings (which also operated the North Western franchise) ordered a small fleet of 100mph trains from Alstom. These are designated as Class 175, and have many common parts shared by the 125mph version. One unhelpful feature for train operators is that a Scharfenberg coupler is fitted - this is incompatible with the greater part of the diesel unit fleet.

Another type of unit that uses the same Cummins power pack as the 125mph vehicles is the Class 185 trans-Pennine sets built by Siemens in 2006 and owned by Eversholt Rail. The engine is rated at 750hp, with a maximum speed of 100mph.

Long-term rolling stock strategy

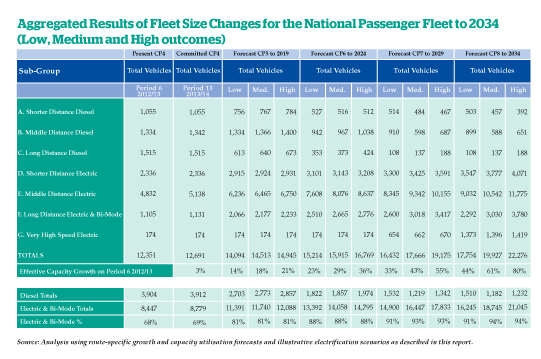

In February 2013, the results of a combined study carried out by Network Rail, the Association of Train Operating Companies, and the three leading ROSCOs and their suppliers were published. The study sought to predict the requirements for passenger rolling stock over a 30-year period to 2042, and although any forecast of this sort is likely to be wide of the mark, it is nevertheless valuable in identifying likely trends.

As a starting point, there is the assumption that the demand for services will increase, if nothing else because the population of the UK is growing and the concentration of city-based employment creates a favourable market for rail. An assessment has been made that the likely growth in passenger miles will be 2.5% per annum, with a higher figure for cities outside London than in the South East.

Electrification will have a significant impact on the type of rolling stock required. NR currently has 19,469 single-track miles open for traffic, of which 7,824 miles (40%) are electrified. A further 1,900 track miles will be wired by the end of Control Period 5, raising that figure to 50%.

Although there is no commitment by the DfT to a continuing programme, this is expected to take place. In Scotland there is a specific objective to have a rolling programme of electrifying 60 single-track miles per annum, following the completion of the Edinburgh-Glasgow Improvement Programme.

The positive benefit:cost ratio of electrifying individual sections of the network suggests that a further 2,136 track miles will justify the installation of overhead catenary in Control Period 6, a further 1,778 miles in CP7, and 1,068 miles in CP8 (which ends in 2034).

If this takes place, it will mean that 75% of the national network will be electrified and will result in vehicles equipped for electric current collection comprising more than 90% of the fleet.

Peer review: Chris Green

Peer review: Chris Green

Former Managing Director, Network SouthEast

Travelling around the UK rail network today is a reminder of how dramatically modern train standards have risen in my lifetime, in both performance and customer standards. My early memories of DMU travel are of drivers topping up overheating radiators from watering cans. Today, failures in service are rare, and passenger quality has been revolutionised with air conditioning, passenger information systems and WiFi becoming the norm.

Competitive tendering is sometimes blamed for creating a multiplicity of designs, but in my experience the fault usually lies with weak specifications by the purchaser.

In my BR days with Network SouthEast, we put years of effort into specifying robust equipment for the new Networker 465 train. The weakest link was always going to be door reliability, and so we held technical competitions to test rival products to destruction until we found the most reliable product for inclusion in the specification. The competitive tendering was on price, quality and delivery dates - not on random choice of equipment.

Competitive tendering can, of course, bring innovation where it is appropriate. The Virgin Trains bid for West Coast Trains in 1996 was based on the bold decision to bring tilting trains back to the West Coast in partnership with Angel Trains - despite the failure of BR’s Advanced Passenger Train (APT).

I also commend the trend towards manufacturers maintaining any new fleets that they build - but not the older inherited fleets. Manufacturers will admit in private that when designing a new train, they are more likely to invest in more robust equipment if they know that they are going to be held to tough reliability targets for the next 30 years. I found this worked well on both the Pendolino and Voyager fleets - but it was not a success on the legacy locomotive-hauled fleets, where the maintenance should have been retained with the in-house experience.

I believe that Britain is now well placed to expand its rolling stock fleets as demand rises. Each market has a choice of quality trains from competing manufacturers, and tighter specifications have resulted in a converging of standards and compatibility. The intercity market is about to get its standard product for the coming decades in the shape of Hitachi Super Express assembled in Britain; the extensive EMU and DMU markets have two quality competitors to choose from in the Siemens Desiros and the Bombardier Electrostars/Turbostars; and then there’s the emerging Hitachi AT200 EMU.

But Mike Jones is absolutely right to highlight the extraordinary failure of the rail industry to identify a standard UK train coupling. This is the result of weak specification, rather than of competitive tendering. We still need to achieve compatibility around a single mechanical coupler that would allow any train to assist any other failed train off the main line.

Peer review: Tim Burleigh

Peer review: Tim Burleigh

Relationship Development Manager, Eversholt Rail Group

Mike’s article rightly highlights the rapidly changing nature of the UK railway, and the expectation of continuing demand growth. A key aim of the industry’s long-term rolling stock strategy was to raise stakeholder awareness of the quantum and type of additional rolling stock, and the investment that would be needed to meet a range of demand growth and electrification scenarios.

The industry must meet this growing demand affordably and ensure that growth is sustained by providing solutions that appeal to passengers as well as train operators. We believe that this is best achieved through a combination of new-build procurement and targeted enhancements to existing rolling stock.

In both cases, the solutions must combine reliability - a major driver both of passenger satisfaction and dissatisfaction - with a passenger environment and functionality that meets ever-growing expectations. This is not a ‘once and for all’ activity, and requires regular reappraisal throughout the product lifecycle. Investment in concept demonstrators for suburban and intercity rolling stock has provided invaluable stakeholder feedback to inform future specifications.

Electrification and other improvements to enhance the overall capacity of the ‘Classic’ network (soon to be overlaid with the impact of HS2, HS3 and other high-speed lines) increase the likelihood of rolling stock cascade. In recent years, we have seen a range of diesel and electric fleets, several of them very early in their service lives, redeployed and reconfigured. This trend will undoubtedly continue. Mike also outlines how the major rolling stock manufacturers supplying the UK market have developed core product families. These families are well-aligned with the categories and roles suggested in the industry long-term rolling stock strategy, yet provide flexibility to tailor some aspects (such as seating configuration) to meet specific operator needs.

It’s also worth noting that within each of these product families (particularly the Bombardier Electrostar and Siemens Desiro EMUs) there has been considerable evolution to incorporate technologies and features that both maximise reliability and reduce operating costs and environmental impact. We must be careful not to stifle such evolution and innovative solutions through an excessive insistence on backward compatibility.

Consideration of ‘standardisation’ should also embrace more than just the rolling stock design itself - it’s also about how and where the trains are deployed. Greater effective capacity can be achieved from the existing UK passenger fleet, by ensuring that future cascades are targeted at building up a critical mass of rolling stock well-matched to the needs of the region or franchise, rather than a variety of smaller fleets.

It is more important than ever that the specification of new-build rolling stock and the enhancement of existing fleets is undertaken with a long-term perspective on utility and flexibility, to maximise the potential for future redeployment.

Peer review: Alistair Dormer

Global Chief Executive Officer, Hitachi Rail

Mike Jones delivers a factual history of rolling stock procurement in the UK over the past 50 years or so. Rolling stock procurement methods have been hotly debated in the rail and national media over the past few years, unlike any other market known to Hitachi. This is primarily down to the uniquely fragmented structure of our industry, post-privatisation, and a lively and knowledgeable trade media. With government specifying services, TOCs holding relatively short-term franchises, ROSCOs owning the rolling stock, and Network Rail maintaining/upgrading the infrastructure, compared with most markets it is a complex contracting environment with many stakeholders.

I do, however, disagree with a few of Mike’s statements. In the UK, rolling stock manufacturers are required to take significant financial delivery and performance risk, while TOCs must be confident of delivery to maximise the revenue boost generated by the new trains.

Yet despite this, the UK has a very competitive rolling stock market, with more suppliers than any other single European market. I do not agree that the UK has restricted market entrants, as we operate trains manufactured (in whole or in part) in the UK, Germany, Italy, Japan, Belgium and Spain. The UK is actually a very open and transparent market, which is why Hitachi came here 15 years ago.

The post-privatisation rolling stock TOC/ROSCO model has been highly successful and has delivered massive passenger growth. Back in the mid-2000s, however, the DfT was becoming frustrated with what it perceived as ROSCOs charging high lease costs yet taking no performance risk - a complaint subsequently rejected by the competition commission.

The DfT felt it was picking up the bill, via Network Rail, for power upgrades and additional track repairs caused by new trains - over which they had no technical control - being more power hungry and less kind to the track.

With this in mind, the DfT set out in the Intercity Express Programme to increase competition for finance, to force financiers to take performance risk, to standardise rolling stock and to consider the infrastructure costs in new train design. These are all laudable objectives, but despite extensive consultation on rolling stock specifications, the TOCs were opposed, as they had lost their role specifying the rolling stock (despite being the interface with passengers and taking some revenue risk). The ROSCOs were also opposed, as this was a challenge to their market dominance and would end the HST ‘cash cow’. These opinions were expressed in the Andrew Foster review, which unfortunately favoured uninformed opinion over fact, so it was soon discredited.

Mike is not correct in his reason for the delays to the IEP project financing. Yes, new financiers do not know the rail market as well as ROSCOs, but that is the role of the lender’s technical advisor (Halcrow, in the case of IEP). The main cause of delay was the financial crash, which removed almost all liquidity (lending) from the markets (including ROSCO funding), followed by the election of a new Coalition Government with a mandate to cut projects and cost. Therefore, the programme was delayed, as the markets recovered and all major projects underwent extensive government review to confirm value for money.

So, has this new form of funding worked? IEP is often criticised as the most expensive train programme ever. Well, new high-quality Intercity trains are not cheap, and finance costs were high in 2012 when the project reached financial close.

That said, Intercity trains are more expensive than commuter trains. Back in the day, the HSTs were much more expensive than standard units, as were the Virgin/Angel Pendolinos when purchased, so it is no surprise that the Class 800 is also more expensive than commuter EMUs today.

As is standard in PPP deals, the DfT has the right to request Agility Trains to re-compete lenders to seek cheaper finance throughout the project life (similar to remortgaging your house if better deals become available), with the vast majority of savings going back to the Government. Indeed, the Great Western tranche is already being tendered for cheaper finance and will no doubt be refinanced again after delivery of the trains, reducing the cost yet further.

The project has introduced many new investors and lenders to rail. Rather perversely (against the DfT’s original objective), this has benefited the ROSCO owners, who have seen the value of their businesses increase significantly (as demonstrated in the recent sale of Porterbrook). However, we are now seeing companies such as SMBC making highly competitive bids for leasing contracts, so I believe the objective of increasing competition in the leasing market will be delivered effectively.

The other objectives of reducing lifecycle cost have been successful - the industry is now much more alive to track access and energy consumption costs, spawning a new generation of EMU designs from manufacturers. Standardisation is being delivered, with a common Intercity fleet on the Great Western and East Coast lines and a once-in-a-generation investment in Intercity depots being realised. The objective of forcing financiers to take performance risk is (in theory) achieved, although in practice 99.99% of risk has flowed down to Hitachi, so manufacturers must be highly competent and financially strong to play in this market long-term.

The debate will doubtless continue, but what is clear is that the UK needs further investment in rolling stock. I suspect the DfT would rather let the market decide. However, as the funder of last resort, it must retain a significant interest in the market. Then, of course, there is the small challenge of how to fund HS2 rolling stock…

Login to comment

Comments

No comments have been made yet.